Do you have dependants?

If you have people in your life that rely on you for support, letting the Canada Revenue Agency (CRA) and Revenu Québec know about them allows you to claim certain tax credits and benefits.

As a rule, a dependant is someone who meets all of the following conditions:

- Relies on you financially or physically

- Lives with you and

- Is either under the age of 18, a parent or grandparent, or mentally or physically infirm (you might also be able to claim expenses for a dependant relative that’s related to you by blood, marriage, a common-law partnership, or adoption)

You might be able to claim the following credits and benefits, provided you meet the eligibility requirements:

- Canada child benefit (CCB)

- Children’s fitness and arts amount*

- Amount for an eligible dependant

- Child care expenses

- Adoption expenses

- Medical expenses (for children under 18)

- Medical expenses (for dependants over 18)

- Tuition amounts**

- Disability amount

- Canada caregiver credit

- Amount for a child enrolled in post-secondary studies (Québec residents)

- Respite of caregivers (Québec residents)

- Child assistance (Québec residents)

Notes:

*The children’s fitness (or physical activity) and arts amount is only available to residents of certain provinces. Click here to see if this tax credit is available in your province or territory of residence.

**Alberta, Ontario and Saskatchewan residents can no longer claim the provincial tuition amounts. Any unused provincial tuition amounts from prior years are still claimable. Your dependant can still claim, transfer, or carry forward federal tuition amounts.

To add a dependant to your return, follow these steps in H&R Block’s tax software:

-

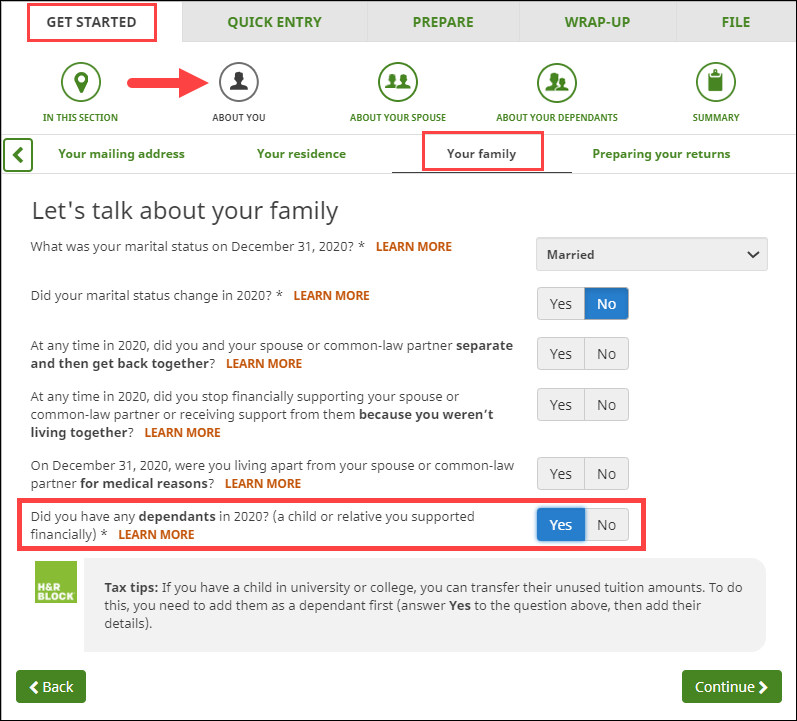

On the Your family page (under the ABOUT YOU icon on the GET STARTED tab), select Yes in response to the question: Did you have any dependants in 2020?

-

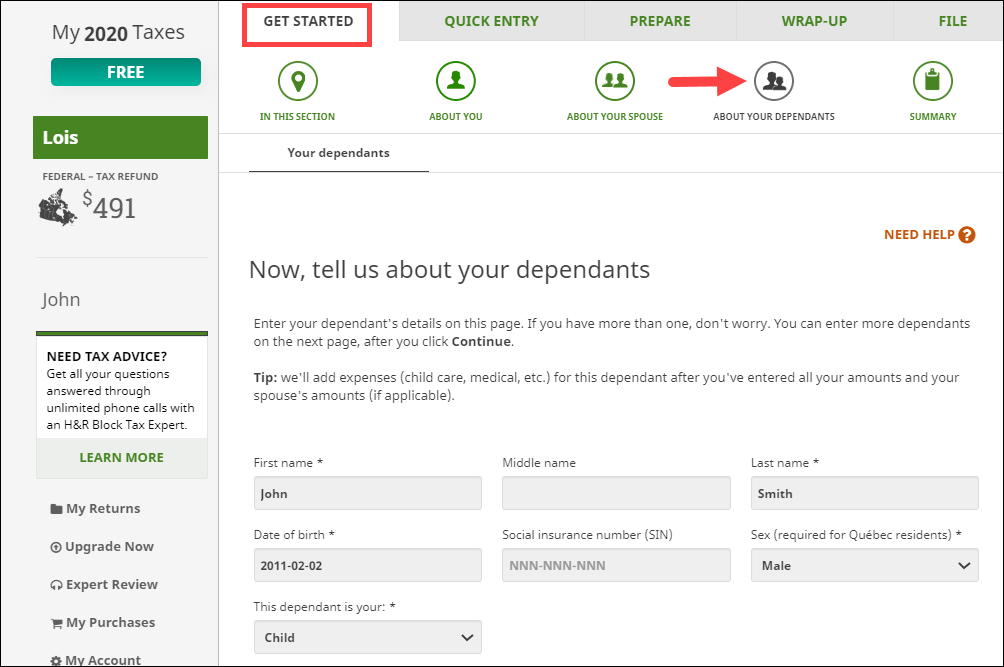

Go to ABOUT YOUR DEPENDANTS and add your dependant’s information. Then, click Continue.

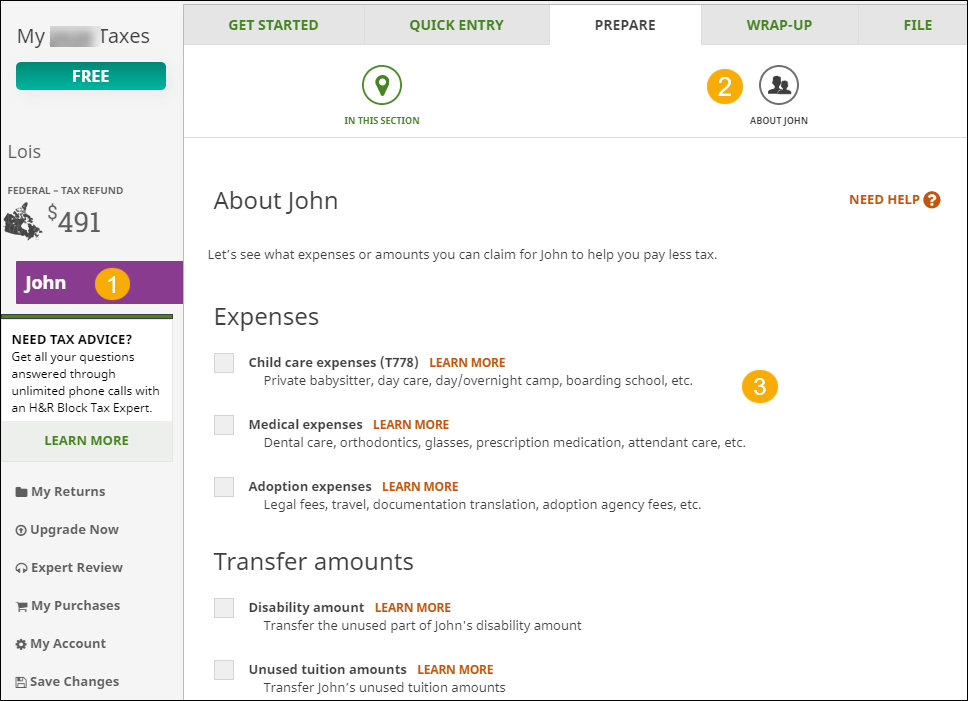

Now that you’ve added your dependant to your return, you can claim their expenses. To do this:

No, if you're paying child support for your child, you can't claim him or her as an eligible dependant. Refer to the CRA website for more information.

- 5000-S5 - Schedule 5 - Amounts for Spouse or Common-Law Partner and Dependants - Common to all (CRA website)

- Dependants (Revenu Québec website)