T778: Child care expenses deduction

You can use form T778: Child care expenses deduction to claim child care expenses you paid for your child(ren) in 2020.

You can claim child care expenses if you or your spouse or common-law partner paid someone to look after an eligible child so that you (or both of you) can:

- Earn income from employment

- Carry on a business either alone or as an active partner

- Attend school (certain conditions apply) or

- Carry on research or similar work, for which you received a grant

For your expenses to qualify, you or your spouse must have paid for child care while the child lived with you. As a rule, only the payments for services provided in Canada by a Canadian resident can be deducted on your return.

If you’re married or in a common-law relationship, the person with the lower net income must be the one to claim the child care expenses. However, there are certain situations that allow the person with the higher net income to claim these expenses. Refer to Part C or D of form T778 to see if any of these scenarios apply to you.

Remember: You'll need your receipts to claim your child care expenses! Every receipt needs to be made out to the person who paid for the child care expenses. If the child care services were provided by an individual, the receipt should also show the caregiver's SIN (Social Insurance Number). You don't have to submit your receipts if you're filing electronically, but you do need to keep them in case the Canada Revenue Agency (CRA) asks to see them.

Note: If you're a resident of Ontario and you qualify to claim the federal child care expenses amount, you’re also entitled to claim the Ontario childcare access and relief from expenses credit (CARE). H&R Block’s tax software will automatically apply this credit to your return based on the information you entered on the T778 page.

You can claim the cost of the following child care services:

- Child care services provided by caregivers (including babysitters and nannies)

- Nursery schools and daycare centres

- Child care services provided by educational institutions (only the part of your fees related to child care can be claimed)

- Day camps and day sports schools where the primary goal of the camp is to care for children (an institution offering a sports study program is not a sports school) or

- Boarding schools, overnight sports schools, or camps where accommodation is involved

Note: This isn’t a complete list. For example, you can also claim the cost of advertising expenses or placement agency fees paid to hire a nanny. For more information on which expenses you can claim, visit the CRA website.

If the child care is provided by an individual, he or she can’t be:

- the child’s parent

- your spouse, if you’re the father or mother of the child

- a person for whom you or another person claimed any of the following amounts

- a person under 18 years of age who is related to you by blood, marriage or common-law partnership, or adoption. For example, your brother, sister, brother-in-law, sister-in-law are related to you; your niece, nephew, uncle, and aunt are not.

The maximum amount you can claim is:

- $8,000 for each child under 7 years of age at the end of the year

- $5,000 for each child between 7 and 16 years of age

- $11,000 for each child who qualifies for the disability tax credit

The maximum amount you can claim also depends on your earned income for the year. As a rule, you can only claim an amount that doesn’t exceed 2/3 of your earned income.

Example: In 2020, your earned income for the year was $40,000. In order to work, you paid $ 20,000 in child care expenses for your three children ages 2, 9, and 11. The maximum you will be able to claim would be the lesser of:

- 2/3 of your earned income i.e. $40,000 X (2/3) = $24,000

- Maximum claimable amount i.e. ($8,000 + (2 X $5,000)) = $18,000

- Actual amount paid i.e. $20,000

In this case, you’ll be able to claim $18,000 in child care expenses on your return.

Tax tip: Make sure you enter the full amount of child care expenses you paid in the tax software for each child. Using the example above, let’s say you no longer have childcare expenses for your 11-year-old, but you’ve paid $15,000 in child care expenses for your other children, you’ll still be able to claim the full amount you’ve paid instead of the maximum allowable of $13,000 ($8,000 +$5,000). That’s because the more eligible children you have, the higher your allowable amount, even if you don’t have child care expenses for some of them.

If you’re a Québec resident, you can claim your childcare expenses if you meet the eligibility requirements for the tax credit and you complete the Schedule C: Tax Credit for Childcare Expenses form.

Note: H&R Block’s tax software will automatically complete your Schedule C for you based on the information you enter on the Relevé 24: Childcare Expenses (RL-24) and the federal T778 page in the software.

For certain childcare expenses, your RL-24 slip might note specifying the amounts that can be used to claim the federal deduction (on the T778 form). When you enter information on the RL-24 page into H&R Block’s tax software, we’ll automatically use this information to claim a federal deduction for your childcare expenses on the T778 page in the software.

To enter childcare expenses from your RL-24 slip into H&R Block’s tax software:

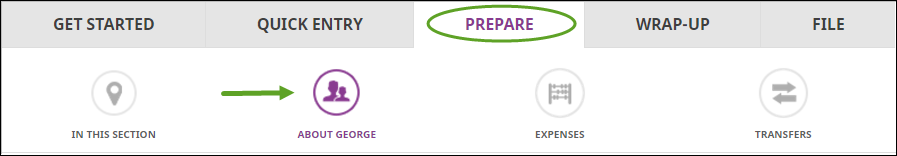

Before you begin, make sure that you’ve told us about your dependant(s) for whom you’ll be claiming childcare expenses:

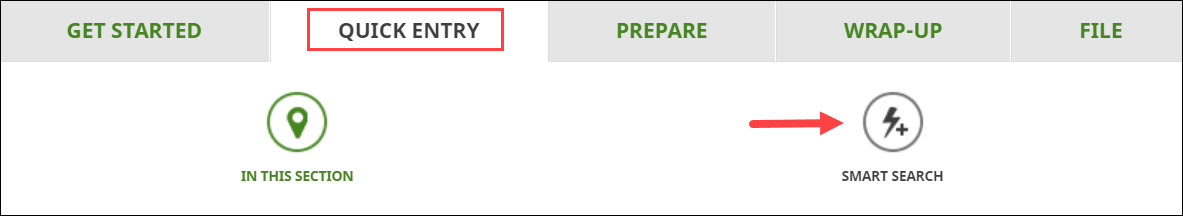

- Type RL-24 or relevé 24 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your RL-24 slip, enter your information into the tax software.

- If you’re claiming childcare expenses for more than one dependant, click + Add Expenses for Another Child, and enter your information into the tax software.

If you didn’t receive an RL-24 slip, make sure you have the name and social insurance number (SIN) of the person you paid childcare expenses to. Then, follow these steps:

-

Add the RL-24 page to your return (see steps above).

-

On the RL-24 page, enter information related to your childcare expenses.

Note: You’ll need to enter the SIN of your childcare provider in box H on the RL-24 page.

According to the CRA, if you paid an amount that qualifies as child care expenses and the provincial children’s fitness/physical activity/sports or arts amount, you must first claim the amount as a child care expense. Any unused amount can then be applied towards the provincial children’s fitness/physical activity/sports or arts amounts.

Note: The federal children’s fitness and arts amounts have been eliminated for 2017 and subsequent tax years.

You can, but it’s important to remember that any child care expenses you might’ve paid can only be applied against your earned income – income that is received from:

- Employment

- Self-employment activities and

- Scholarships, research grants, etc.

Example:

Let’s say that you earned $7,500 working at your part-time job in 2020. In addition to your employment income, you received $2,500 in Employment Insurance benefits as a result of being laid off. In this scenario, any deduction that you’re entitled to claim for child care expenses will only be based on your employment income ($7,500).

Follow these steps in H&R Block’s 2020 tax software:

Before you begin, make sure that you’ve told us about your dependants for whom you’ll be claiming child care expenses.