Tuition tax credit (Schedule 11 and Schedule T)

If you're a student, you can use Schedule 11 to:

- calculate and claim your federal tuition tax credit

- determine the tuition credit amount for the year that can be transferred to a family member

- determine the unused tuition credit amount that you can carry forward to use in a future

- claim the Canada training benefit

You can claim the tuition tax credit on eligible fees you paid to an educational institution during the year, as long as you received a tax certificate from your school (such as a T2202, TL11A, or TL11C) stating the fees you paid during the year. You can claim all amounts that are more than $100. You can also claim fees paid to an educational institution to take an occupational, trade, or professional exam to obtain a license or certification as a tradesperson or a professional status, as long as you have the receipt.

Note: H&R Block’s tax software will automatically complete your federal Schedule 11 for you based on the information you enter into the software from your tax certificate.

You can’t claim the tuition tax credit if your fees:

- was paid or reimbursed to you by your employer, or your parent’s employer, and the amount isn’t included in your or your parent's income

- was paid by a federal, provincial, or territorial job training program, and the amount isn’t included in your income

- was paid (or eligible to be paid) under a federal program to help athletes, and the payment or reimbursement hasn’t been included in your income

Yes. You should complete Schedule 11 even if you don’t have to pay income tax in 2020. Doing so allows the Canada Revenue Agency (CRA) to update their records on the credit amount that you can carry forward and claim in a future year.

If you don’t need to claim all or a portion of your 2020 tuition tax credit to reduce your tax payable to zero, you can:

- transfer the unused tuition credit amount to a family member (spouse, common-law partner, parent, or grandparent) to help them reduce their taxes or

- carry forward the unused tuition credit amount and claim it in a future year when you do have tax payable

Keep in mind, you can only transfer the current year tuition amounts. For more information on transferring tuition amounts to your family, refer to the Where do I transfer my unused tuition tax credit? section below or our online help centre article, How can I transfer my unused federal tuition amounts to my spouse, common-law partner, or relative?.

If you’re eligible to claim the federal amount, you’re also entitled to claim a corresponding provincial or territorial tax credit. Fortunately, H&R Block’s tax software automatically completes your federal and provincial Schedule 11 forms for you (or Schedule T, if you’re a resident of Québec) based on the information you enter from your tax certificate. Refer to the applicable link below to learn more about your provincial/territorial tuition tax credit:

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Prince Edward Island

- Yukon

Note: The Alberta, Ontario, and Saskatchewan tuition and education credits have been discontinued. If you’re a resident of any of these provinces and you’ve got unused provincial tuition amounts, you’ll still be able to claim them or carry forward these amounts for use on future returns. Keep in mind, carryforward amounts can’t be transferred to a family member and can only be claimed by you.

If you’re a resident of Québec, you’ll also need to complete Schedule T to calculate your Tuition or Examination fees tax credit. Schedule 11 and Schedule T are combined in H&R Block's tax software and you only need to enter information from your federal tax certificate (such as the T2202) and your Relevé 8 to claim this tax credit.

Much like the federal Schedule 11, the Schedule T form is used to claim, carry forward, or transfer the tuition or examination fees you paid in 2020. You can also claim or carryforward fees paid between 1997 and 2019, as long as they haven’t been claimed on a previous Québec return.

To claim this tax credit, the tuition or examination fees that you paid must be at least $100 and must have been paid to a recognized academic institution.

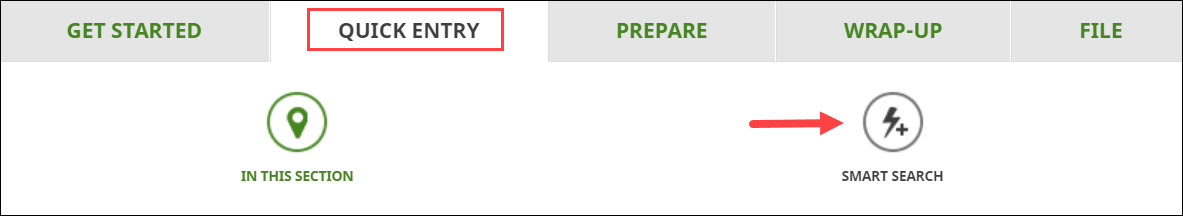

Note: If you received a TL11A or TL11C certificate, be sure to also enter your Relevé 8 (RL-8) slip on the SMART SEARCH page under the QUICK ENTRY tab. If you didn’t receive an RL-8 slip from your school, you’ll need to request them to complete one. Be sure to confirm with the Ministère de l'Éducation et de l'Enseignement supérieur (MEES) that your school is recognized by them for the tax credit. If you’ve confirmed that your fee is eligible for the tuition tax credit but you’re unable to get an RL-8 slip from your school, you can enter information from your TL11A or TL11C certificate into the RL-8 page in H&R Block’s tax software.

The year in which you paid your unused eligible tuition or examination fees is used to determine the tax credit rate that can be applied to this year’s return.

If any of the following situations apply to you, your tuition and examination fee tax credit rate will be 20%:

- You paid eligible fees between 1997 and 2012

- You paid for a semester of post-secondary studies that began before March 28, 2013

- You paid fees to an educational institution that’s recognized by the Minister of Revenue for training other than that which is part of the post-secondary program in which you enrolled before March 29, 2013 and

- You paid fees in 2013 for an exam you took before May 1, 2013

If, however, the fees you paid doesn’t match the criteria listed above or if it was paid after 2013, your tax credit rate will be 8%.

In either case, you can refer to your 2019 Québec notice of assessment (NOA) for a detailed breakdown of these amounts.

Important: To claim your Tuition tax credit, enter the information from your tax certificate (and RL-8 slip, if applicable) into H&R Block’s tax software. The software will automatically complete the federal Schedule 11 (and provincial Schedule 11 or Schedule T, if applicable) for you.

Follow these steps in H&R Block’s 2020 tax software:

- Type the name of the tax certificate you received (such as the T2202, TL11A, RL-8 etc.) in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your tax certificate, enter your information into the tax software.

Note: If you paid examination fees in 2020, enter the amount in box 26 of a new T2202.

Important: You can find your unused tuition tax credit amount that you carried forward from a previous year, on your most recent notice of assessment (NOA) or reassessment.

Follow these steps in H&R Block’s tax software:

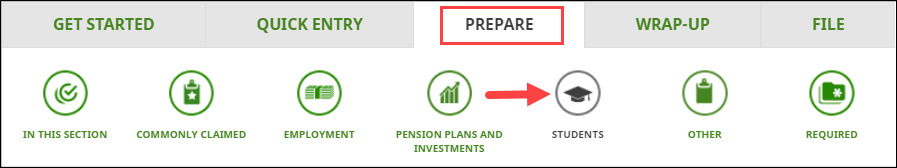

- Under the PREPARE tab, click the IN THIS SECTION icon.

- In the Unused tuition amounts and student loans box, click the Add This Topic button.

- Click the STUDENTS icon. You'll find yourself here:

- Under the CREDIT AMOUNTS section, select the checkbox labelled Unused tuition, education, and textbook amounts, and Canada training credit (Schedule 11) and click Continue. If you’re a Québec resident, select Tuition or examination fees carried forward from a previous year (Schedule 11 & Schedule T) and click Continue.

- When you arrive at the selected page, enter your information into the tax software.

Follow these steps in H&R Block’s 2020 tax software:

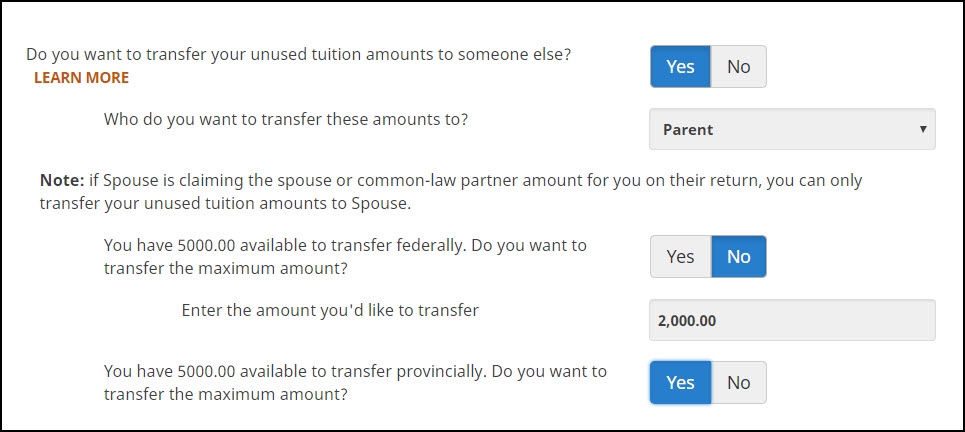

If you indicated that you're single, divorced, separated, widowed, or preparing your return separate from your spouse:

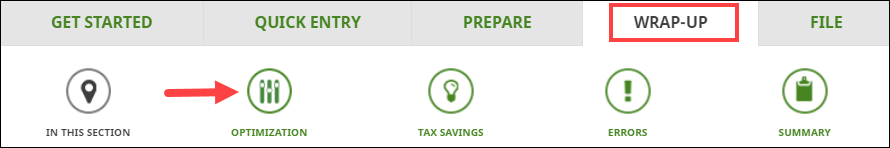

- Under the WRAP-UP tab, click the OPTIMIZATION icon. You'll find yourself here:

- On the Claimed credits page, select Yes in response to the question Do you want to transfer your unused tuition amounts to someone else?.

- Select the person to whom you want to transfer the amount to and if you aren’t transferring the full credit amount, enter the amount you want to transfer.

Note: If you’re transferring your unused tuition amounts to your parent or grandparent, they will have to claim the same amount on their return as a transfer. Refer to our online help article, How do I claim my dependant’s unused tuition amounts?.

If you are preparing your return with your spouse’s (coupled):

- Under the WRAP-UP tab, click the OPTIMIZATION icon.

- On the Optimized credits page, select Yes in response to the question Do you want to make any changes in the table above? (such as changing the optimized amounts or choosing not to claim a credit).

- Select Yes in response to the question We've optimized the unused tuition amounts you can transfer to {spouse}. Do you want to change the amount(s) in the table above or transfer your unused amounts to someone else?.

- From the drop-down menu next to the question Who do you want to transfer your unused tuition amounts to?, select the person you wish to transfer these amounts to.

- Enter the amount you want to transfer.

Note: If you’re transferring your unused tuition amounts to your parent or grandparent:

- They’ll have to claim the same amount on their return as a transfer. Refer to our online help article, How do I claim my dependant’s unused tuition amounts?.

- Your spouse won't be able to claim the following amounts for you: spouse or common-law partner amount and amounts transferred from your spouse or common-law partner