Schedule O: Québec tax credit for respite of caregivers

Schedule O is used by Québec residents to claim a tax credit for the respite of caregivers. If you’re a caregiver for your spouse or common-law partner or a dependant over the age of 18 with a significant disability, you can use Schedule O to claim a credit for expenses you paid in order to get a break from caregiving services.

Note: A dependent can be your or your spouse’s father, mother, child, grandchild, brother, sister (or their spouse), nephew, niece, uncle, aunt, great-uncle, or great aunt.

To claim this credit, you must’ve been a resident of Québec on December 31 for the year you’re claiming this credit, and you must’ve paid for specialized respite services.

You can claim up to $5,200 in eligible expenses paid in the year for specialized respite services for a maximum credit amount of $1,560. The tax credit gets reduced by 3% for the part of your family income that is over $58,380.

Keep in mind, you can’t use these expenses to claim any other tax credit on any return and only the person who is the primary caregiver can claim this tax credit.

Before you begin, make sure you’ve indicated that you lived in Québec on December 31, 2020.

-

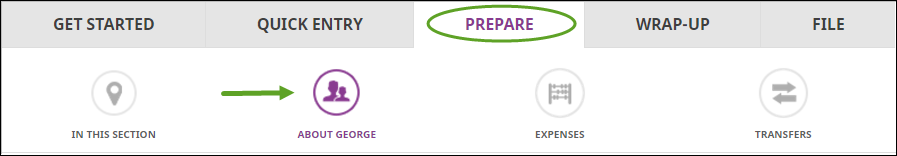

Under the PREPARE tab, click the OTHER icon.

You'll find yourself here:

-

Under the DISABILITY-RELATED CARE heading, click the

checkbox labelled Tax credit for respite of caregivers (Schedule O),

then click Continue.

- When you arrive at the Tax credit for respite of caregivers (Schedule O) page, enter your information into the tax software.

If you want to claim this tax credit for a dependant with a significant disability who is over the age of 18, along with selecting Québec as your province of residence on December 31, be sure to also provide details for your dependant on the ABOUT YOUR DEPENDANTS page. Then:

-

Click on your dependant’s name in the left-navigation panel. You'll find

yourself here:

-

Under the Tax Credits section, select

Tax credit for respite of caregivers (Schedule O) and

click Continue.

- When you arrive at the Tax credit for respite of caregivers (Schedule O) page, enter your information into the tax software.