I don’t have a T2202 slip for the examination fees I paid. How do I claim this?

If you paid examination fees to take an occupational, trade, or professional exam to obtain a professional status or to be licensed or certified as a tradesperson, so that you can practice the profession or trade in Canada, the amount might be eligible for the Tuition tax credit.

Note: You must have paid this fee to an educational institution, professional association, provincial ministry, or another similar institution and received an official receipt for it.

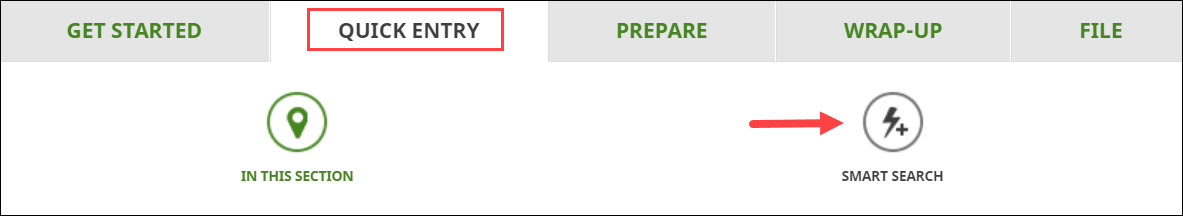

To claim your examination fees in H&R Block’s tax software, you’ll need to enter the examination fees you paid in 2020 on the T2202 page. Here’s how to do that:

- Type T2202 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the T2202 page, enter your examination fees in box 26.