Relevé 24: Childcare Expenses

Your Relevé 24 (RL-24) slip, issued by your childcare service provider, shows the total amount paid for childcare expenses during the year. As long as they offer childcare services, an eligible provider can include:

- Daycare centres

- Boarding schools

- Overnight camps

- Day camps or

- Nursery schools

In addition to receiving an RL-24 slip from your childcare provider, you must also meet the eligibility requirements outlined by Revenu Québec in order to claim the tax credit for childcare expenses.

In some cases, Revenu Québec might not require your childcare provider to issue you an RL-24 slip. If so, make sure you get their name, address and social insurance number (SIN) when getting your receipt. Be sure to keep this information with your receipt in case Revenu Québec asks to see it at a later time.

The Québec tax credit for childcare expenses you receive will be the lesser of:

-

Your qualifying childcare expenses for the year, or

The maximum amount you can claim also depends on your earned income for the year.

No. Some expenses, like those shown in Box D, don’t qualify for this credit. For a complete list of non-qualifying expenses, refer to the Revenu Québec website.

Note: Even if certain amounts reported on your paper RL-24 slip, are considered non-qualifying expenses by Revenu Québec, you’re still required to report them when completing your return.

Yes. H&R Block’s tax software will automatically transfer the amounts you enter from your paper RL-24 slip onto your Schedule C: Tax credit for childcare expenses.

For certain childcare expenses, this information will also be used to claim a federal deduction on the T778: Child Care Expenses page. These qualifying expenses can include:

-

Childcare provided by an individual (for example, a babysitter or nanny)

-

Nursery school or daycare

-

Childcare services provided by educational institutions (only the part of your fees related to childcare can be claimed)

-

Day camps and day sports schools where the primary goal of the camp is to care for children (an institution offering a sports study program is not a sports school) or

-

Boarding schools, overnight sports schools, or camps where accommodation is involved

Notes:

-

Although many of the amounts that you entered from your RL-24 are used to claim federal deductions, you might still have separate expenses you’ll need to claim on the T778 page.

-

Keep in mind that there are different maximum amounts to the expenses you can claim for your provincial and federal deductions.

To find the T778 page:

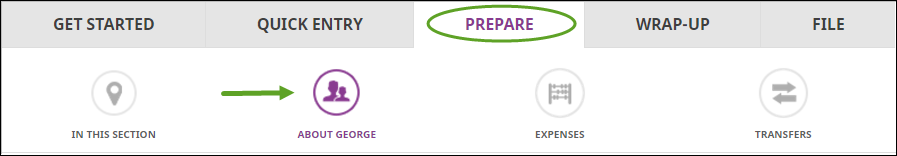

Before you begin, make sure that you’ve told us about your dependant(s) for whom you’ll be claiming childcare expenses:

- Type RL-24 or relevé 24 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your RL-24 slip, enter your information into the tax software.

If you didn’t receive an RL-24 slip, make sure you have the name and social insurance number (SIN) of the person you paid childcare expenses to. Then, follow these steps:

-

Add the RL-24 page to your return (see steps above).

-

On the RL-24 page, enter information related to your childcare expenses.

Note: You’ll need to enter the SIN of your childcare provider in box H on the RL-24 page.

If you’re married or in a common-law relationship, the higher income earner will automatically claim the Québec tax credit for childcare expenses in H&R Block’s tax software to help reduce the taxes you owe. However, you can choose to split this tax credit instead.

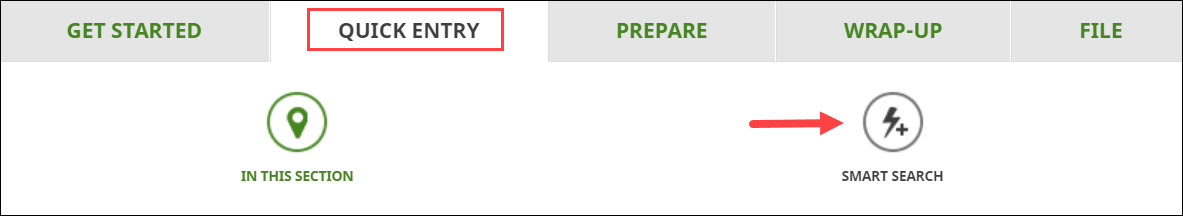

Follow these steps in H&R Block’s 2020 tax software:

-

Under the WRAP-UP tab, click the OPTIMIZATION icon.

-

Go to the Dependant amounts page.

-

If you’re the higher income earner, select Yes next to the question: You're claiming ${amount} for the Québec tax credit for childcare expenses. Do you want to split this credit with {spouse} instead?

If your spouse is the higher income earner, select Yes next to the question: {spouse} is claiming ${amount} for the Québec tax credit for childcare expenses. Do they want to split this credit with you instead?

-

Enter the amount you want the lower income earner to claim into the tax software.