Statement of Real Estate Rentals (T776 and TP-128-V)

If you had rental income in 2020 from renting out a property that you own or co-own (a house, an apartment, rooms, space in an office building, or other property), you’ll need to use the T776 form to report your gross rental income, expenses, and any capital cost allowance for the year.

Note: If you’re a resident of Québec, you’ll also need to complete the TP-128-V: Income and expenses respecting the rental of immovable property form. The T776 and the TP-128-V forms are combined in H&R Block's tax software, so you can complete both at the same time.

The rental income you receive can be in the form of cash or cheque, services, or kind (goods instead of cash) and might include more than the rent you receive each month. Your rental income can also include the following:

- Premiums and leases which are amounts for:

- Granting or extending a lease or sublease

- Permitting a sublease or

- Cancelling a lease or sublease

- Sharecropping (which is income from renting farmland for cash or as a share of the crop)

Tax tip: If you had rental income from sharecropping, report any cash received as gross rent and the fair market value of your crop share as other related income on the T776/TP-128-V page in H&R Block’s tax software.

If you’re earning income from renting out a space and by providing basic services only (such as heat, light, parking, and laundry services), you’re earning rental income. If you’re providing additional services to your tenants such as cleaning, security, and meals, you’re likely operating a business. If that’s the case, you’ll need to complete the T2125/TP-80: Statement of business or professional activities form instead of the T776/TP-128-V.

Generally, if you own the property with someone else (like your spouse or common-law partner), you are considered a co-owner. If, however, you own the property with one or more people and are carrying on a business with the intent to make a profit, you are in a partnership. For more information on determining if you are a partnership, refer to Income Tax Folio S4-F16-C1, What is a Partnership?.

Rental income is usually reported on a calendar year basis – from January 1 to December 31. In most cases, you’ll calculate your rental income using the accrual method. According to this method, you:

- include rents in income for the year in which they’re due, whether or not you receive them in that year and

- deduct your expenses in the year you incurred them, regardless of when you actually paid them

However, if you have no rent receivable and no expenses outstanding at the end of the year, you can use the cash method. According to this method, you include rents in income in the year you receive them and deduct expenses in the year you pay them. You can use the cash method only if your net rental income or loss would be practically the same if you were using the accrual method.

If you’re a co-owner or a partner in a partnership, your share of the rental income or loss will depend on your share of the ownership. When you enter your total rental income for the year in H&R Block’s tax software, your share of the rental income or loss is automatically calculated based on your percentage of ownership. For example, if you and your spouse each own 50% of your rental property, enter the percentage you own on the T776 page. When you enter the rental income and expenses for the property, the tax software will automatically allocate 50% of the income or loss to you.

Note: Each co-owner or partner in a partnership needs to complete their own T776 in their return.

Remember, keep all records related to your rental property income and expenses in case the Canada Revenue Agency (CRA) and/or Revenu Québec asks to see them later.

Generally speaking, you can deduct any reasonable expense you paid to earn rental income. The two basic types of expenses are:

- current expenses and

- capital expenses

Current expenses are on-going expenses that provide a short-term benefit. For example, you can deduct the cost of repairs to keep a rental property in the same condition as it was when you bought it and claim the cost of using your car to transport tools to the property for such repairs. You can deduct current expenses from your gross rental income in the year you paid them. Refer to the Canada Revenue Agency (CRA) website for a full list of current expenses you can deduct.

On the other hand, capital expenses provide a benefit that usually lasts for several years. For example, costs to buy or improve your property are capital expenses. Generally, you can’t deduct the full cost of these expenses in the year you paid them. Instead, you deduct their cost over a period of several years as capital cost allowance (CCA). Capital expenses can include:

- the purchase price of rental property

- legal fees and other costs connected with buying the property and

- the cost of furniture and equipment you are renting with the property

Note: You can’t deduct expenses such as the value of your own labour, penalties shown on your notice of assessment or reassessment, your mortgage principal, or land transfer taxes.

The CCA or the cost of depreciation you can claim depends on the type of rental property you own and the date you bought it. A specific rate of CCA applies to each class of property. For example, if you have a rental building which you bought after 1987, it belongs to Class 1 and has a CCA rate of 4%. If you bought a building in Canada after March 18, 2007, you might qualify for an additional allowance, increasing your CCA rate to 6%. To be eligible, you need to use at least 90% of the building for rental purposes.

You claim CCA on the capital cost of the property minus the CCA, if any, you claimed in previous years. The remaining balance declines over the years as you claim CCA. Click here to find out what class your rental property belongs to.

Notes:

You can usually claim CCA on half of the net additions to a class, in the year you bought the property. If you purchased or made improvements to depreciable property in the year, the CRA considers these to be additions to the class in which the property belongs. On the T776/TP-128-V page in H&R Block’s tax software, enter the total business part of the cost you paid to buy or improve the properties that belong to the same class. Click Add another class, to enter the cost of additions for a different class.

You don’t have to claim the maximum amount of CCA for the year; you can claim any amount that’s less than the maximum allowed. When you claim CCA, it reduces the balance of the class by the amount you’ve claimed, so you have less to CCA to claim in future years. For example, if you don’t have to pay income tax for 2020, you might not want to claim CCA for the year.

The amount that’s left after you deduct your CCA from the total capital cost of your property is the undepreciated capital cost (UCC). Each year, the CCA you claim reduces the UCC of the property. In other words, your UCC at the start of the year is:

Total capital cost minus CCA claimed in the previous years

If you rent out a portion of the residence where you live, you can claim the amount of expenses you paid during the year that relate to the rented portion of the building. To do this, you’ll need to divide the expenses for the whole property between the part in which you live and the part(s) that you rent out. You can split the expenses using the area (for example, square meters) or the number of rooms you are renting in the building, as long as the split is reasonable.

For example, if you rent 5 out of the 10 rooms in your house you can deduct:

- 100% of the expenses that relate specifically to the rented rooms (like repairs and maintenance) and

- 50% (5 out of 10 rooms) of the expenses that relate to the whole building (like taxes and insurance)

If you have a lodger in your home, you can also claim expenses for rooms that you aren’t renting but that both you and your lodger use on a regular basis.

When completing the T776/TP-128-V page enter the full amount of the expenses in the column labelled Total amount paid. In the Personal portion column, enter the part of each expense that was for personal use.

If you sold or are considered to have sold your rental property during the year, you’ll need to report the amount you received from the sale (proceeds of disposition) to the CRA by completing the Schedule 3 (and Schedule G, if you’re a Québec resident) form.

Note: The Schedule 3 and Schedule G forms are combined in H&R Block’s tax software.

In the year you dispose of a rental property, you may have to add an amount to your income as a recapture of CCA or deduct an amount from your income as a terminal loss.

A recapture of CCA can occur, when the proceeds from the sale of your rental property are more than the total of:

- the UCC of the class at the start of the year and

- the capital cost of any additions during the year

You have a terminal loss when you have disposed of all property within a class during the year, but you still have an amount that you haven’t deducted as a CCA. In the year that you dispose of your rental property, you can subtract your terminal loss from your rental income.

During the year, if you paid to renovate, improve, maintain, or repair a property in Québec that you used to earn rental income, you’ll need to complete a TP-1086.R.23.12-V form to report these expenses. Fortunately, questions from the TP-1086.R.23.12-V form have been added to the T776 page in H&R Block’s tax software so you only need to enter your expenses in one place.

Even if the property that generated rental income for you in 2020 is located outside of Canada, you still need to report this income on the T776 page of your return. You might notice that the T776 page in H&R Block’s tax software doesn’t have a specific place to enter your foreign rental income; don’t worry – you can still enter all the information related to your rental property here and NETFILE your return.

To enter your foreign property address on the T776 page:

- In the Property details section, enter the full address of your foreign property in the Street name field (including the city, country, and postal code).

- In the Province or territory and Postal code fields, enter your Canadian province of residence and postal code.

Once you’ve reported your foreign rental income on the T776 page, you’ll also need to complete the following forms, if applicable:

- T1135: Foreign income verification statement – if you received foreign rental income from a specified property that is over the total cost of Canadian $100,000, you’ll need to provide related information to the CRA.

- T2209: Foreign employment, pension, or investment income (T2209 & TP-772-V) – if you paid income tax to a foreign government on the foreign rental income you received during the year, you might be able to claim the foreign tax credit.

Notes:

- If the CRA needs more information regarding your foreign rental property, they’ll contact you directly.

- Make sure you’ve converted your foreign rental income and expenses to Canadian dollars before reporting it on your return. You can do that here.

Important: If you co-own your rental property with your spouse or common-law partner, both of you must complete the T776 page in your returns with the same information. Remember, you’ll both need to include your percentage of ownership in the Co-owner or partner details section of the page.

If you want to complete both the T776 and TP-128-V, make sure you tell us that you lived in Québec on December 31, 2020.

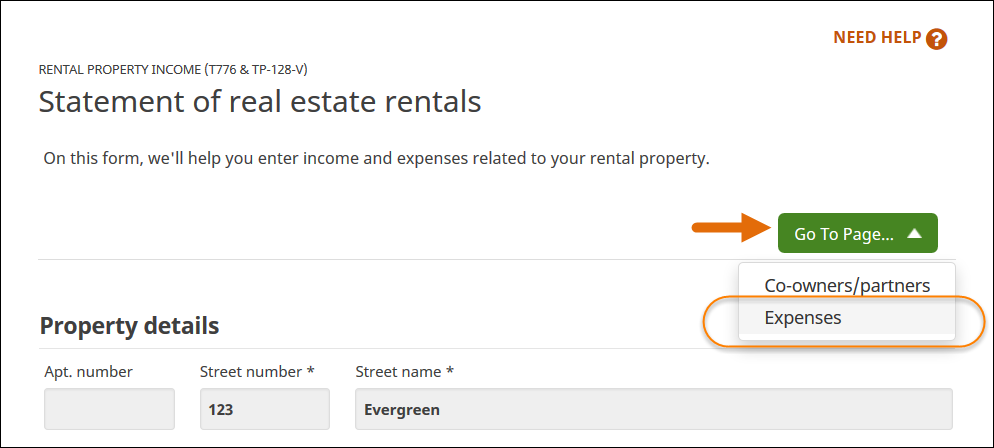

Follow these steps in H&R Block’s 2020 tax software:

- Under the PREPARE tab, click the OTHER icon. You will find yourself here:

- Under the OTHER TYPES OF INCOME section, select the checkbox labelled Rental property income (Income and expenses respecting the rental of immovable property) and click Continue.

- When you arrive at the Rental property income (Income and expenses respecting the rental of immovable property) page, enter your information into the tax software.