Statement of business or professional activities (T2125 and TP-80)

If you were self-employed in 2020, use the T2125: Statement of business or professional activities form to report your income and expenses for the year.

Note: If you’re filing a Québec tax return, you’ll also have to complete a TP-80-V: Business or professional income and expenses in Québec form. Fortunately, the T2125 and TP-80-V forms are combined in H&R Block's tax software.

As a self-employed individual, you have until June 15, 2020 to file your return. However, if you owe taxes to the government, you will need to pay it by April 30, 2020. If you and your spouse are preparing your returns together and only one of you is self-employed, you can still file both returns by June 15th as long as any balance owing is paid by April 30, 2020.

Business income is income from any activity you do for a profit and includes sales, commissions, or fees, and it includes the value of your inventory at the start and end of your fiscal period. Some examples of when you would have business income are, if you’re a retail store owner, wholesaler or distributor, or an automotive dealer.

Professional income is also income from sales or fees but usually includes the value of your work-in-progress (WIP). WIP is goods or services that you haven’t yet finished providing at the end of your fiscal period. For example, you would have professional income if you’re a lawyer, professional engineer, doctor, or freelance instructor.

Follow these steps in H&R Block’s 2020 tax software:

- Under the PREPARE tab, click the IN THIS SECTION icon.

- In the Self-employment income and expenses box, click the Add This Topic button.

-

Click the EMPLOYMENT icon. You will find yourself here:

- If you are filing a:

- T2125 form: Under the BUSINESS AND SELF-EMPLOYMENT INCOME section, select the checkbox labelled Statement of business or professional activities (T2125), and click Continue.

- T2125/TP-80-V form: Under the BUSINESS AND SELF-EMPLOYMENT INCOME section, select the checkbox labelled Business or professional income and expenses (T2125/TP-80-V), and click Continue.

- T2125 form: Under the BUSINESS AND SELF-EMPLOYMENT INCOME section, select the checkbox labelled Statement of business or professional activities (T2125), and click Continue.

- When you arrive at the appropriate page in the software (either the T2125 or the T2125/TP-80-V), enter your information into the tax software.

You can use the T2125 (and TP-80-V, if applicable) form if you have business or professional income and expenses, and if:

- You operate a business yourself (sole proprietor) or

- You operate a business with someone else (as a partner or co-owner)

Click each heading for more details on completing each section of the T2125/TP-80-V (as applicable) page.

Things to remember:

- Enter information in all the fields that apply to your business. Fields with a red asterisk (*) are required fields.

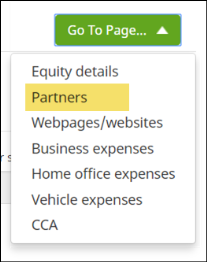

- As you complete the T2125/TP-80-V and answer the questions at the bottom of the main page, you’ll see additional pages (such as Business expenses) added to the Go To Page menu at the top of the form. This menu lists all the pages you need to complete as part of the T2125/TP-80-V and lets you navigate to each page.

- Canadian residents outside of Québec, will not see fields from the TP-80-V form. Information specific to Québec residents only is marked in the sections below with the symbol [QC].

- You’ll need to complete a separate T2125/TP-80-V for each business and/or professional activity you have.

- What type of income did you earn?*

Your self-employment income can be from:

- Business income – income from any activity you do for a profit and includes sales, commissions, or fees

- Professional income – income that is from a profession that has a governing body (such as one for lawyers, professional engineers, etc.)

- Commissions – income that is from commission sales

- Type a keyword (sales, bookkeeping, legal, etc.) to find the industry code that best describes your main business activity*

Enter a keyword that best describes your business activity. For example, if you’re a self-employed bookkeeper, type “bookkeeper” in this field. You’ll be able to see the industry code(s) that best match your entry. If you know your industry code, you can also just enter the number in this field.

If more than one code applies to your business, enter the one that most closely describes your main business activity.

- What type of business do you have? (you own the business by yourself, you have partners, etc.)

Select the ownership structure that applies to your business:

- If you own the business by yourself and you’re fully responsible for its debts, select Sole proprietorship.

- If you own the business with another person or multiple people and you’ve registered it as a partnership (you’ve received a partnership number), select Partnership.

- If you co-own the business with another person (but it isn’t registered as a partnership), and each of you has a share in the business, select Co-ownership.

- What's your share of the business?

If you’re a partnership or co-ownership, enter your percentage of share in the business. This percentage is used to calculate your business income and expenses correctly.

Note: This percentage is not used to calculate your home office expenses or motor vehicle expenses (if applicable) –- those are calculated differently.

Typically, this is a period of 12 months, at the end of which the person carrying on the business prepares financial statements for the year. A fiscal period can’t be longer than 12 months but can be shorter in the year you started your business or ended it.

[QC] If you’re a Québec resident, your fiscal period end date must be December 31. However, if you’re electing to change your fiscal year end to a date other than December 31 for your federal tax return, the election will also apply to your Québec return. Remember, the fiscal period end date for both your federal and Québec return must be the same.

If your fiscal period doesn’t end on December 31, you’ll need to enter a few more details in this section in order to reconcile your business income with the calendar year.

Your responses to the questions below will help personalize your T2125 (and TP-80, if applicable) page.

| Question | Explanation |

|

Did this business have a debt or obligation? Or did you add cash/assets to the business, or use cash, assets, or services from the business for personal use? |

Your business might have assets (such as inventory, equipment, etc.) and liabilities (such as unpaid loans or wages, or interest payable). If so, select Yes to enter your business’ equity details. |

|

Did you earn income from a webpage or website? |

Your business has income from webpages or websites if you sell goods or services through your business’ own webpage or website, on auction, marketplace or similar sites operated by others, or from advertising or traffic your site generates. |

|

Did you use a vehicle (car, station wagon, van, etc.) to earn income? |

If you used your car for business and personal use, select Yes. You can deduct a portion of the expenses that you paid to earn business income. |

|

Do you have any home office expenses related to this business? |

If you used your home for business purposes, select Yes. You can deduct a portion of the expenses based on the amount of space used for your home office. |

|

Do you need to make any capital cost allowance (CCA) claim for assets related to this business? |

You might have bought property such as buildings, equipment, or furniture for your business in 2020. The cost of such property can’t be deducted in the year of purchase. However, as the property wears out over time, you can claim a portion of the cost each year. This deduction is called capital cost allowance (CCA).

If you select Yes, enter details related to the property on the designated pages of the form.

|

|

Do you want to enter information about the companies or persons that have carried out work? (Québec only) |

During the year, if you paid to renovate, improve, maintain, or repair a property in Québec that you used to earn business income, you’ll need to complete a TP-1086.R.23.12-V form to report these expenses. Fortunately, questions from the TP-1086.R.23.12-V form have been added to the T2125 page in H&R Block’s tax software so you only need to enter your expenses in one place. |

Important: If you’re a partner in a partnership that must file a partnership information return, don’t complete this page. Instead, complete the Partners page.

- What was the total amount of liabilities your business had at the end of its fiscal period?

These are the amounts your business owes. Business liabilities can include tax payable, notes, unpaid salaries or wages, interest payable, unpaid loans, etc.

- What was the total value of the drawings you made (including your salary)?

This is the total amount you withdrew in, cash, other assets, and services from your business during the year.

- What was the total amount of your capital contributions?

This is the amount of cash or other assets that were added to your business, including personal funds.

- [QC] What was the balance of your accounts receivable at the end of your fiscal period?

These are the outstanding amounts your business is to receive for its sales or services.

- [QC] What was the balance of your debts other than accounts receivable at the end of your fiscal period?

This is the total amount in loans and advances made to others (such as short-term advances given to staff), etc.

- [QC] What was the amount of your outstanding loans, made to individuals or partnerships, at the end of your fiscal period?

This is the total amount in loans and advances made to others that are still outstanding at the end of the business year.

- [QC] Describe the inventory (goods) your business had at the end of its fiscal period

Enter a brief description of the type of inventory your business had at the end of the year.

- [QC] Where is your inventory located?

Enter the location (such as the business address, storage facility, etc.) where the inventory is located.

- [QC] What's the name of your creditor?

If you’ve leased the movable property or you took a loan to buy the movable property, enter the name of the company from which you’ve leased or borrowed money for this movable property.

- [QC] What's the book value of this property?

This is the amount you paid for the movable property.

- [QC] What's the name of your creditor?

If you took a loan to buy the immovable property, enter the name of the company from which you’ve borrowed money for this immovable property.

- [QC] What's the book value of this property?

This is the amount you paid for the immovable property.

- Your partnership’s business number, assigned by the CRA– Enter the 9-digit business number assigned to your partnership by the CRA. You can find this number on your T5013 slip.

- [QC] Your identification number assigned by Revenu Québec - only enter this number if you lived in Québec on December 31, 2020

Enter the identification assigned to your partnership by Revenu Québec. You can find this number on your RL-15 slip.

- Your gross income from sales, commissions, or other fees (include the GST/HST you collected or will collect on these amounts)

Your gross sales, commissions, or fees include all sales, whether you received or will receive:

- Money

- Something equivalent to money (such as credit units)

- Something from bartering

Remember to include the GST/HST collected or that was collectible on your gross sales, commissions, or fees.

- Taxable gains you received from the sale of eligible capital property*

If you sold capital property that your business owned, and you realized a profit (capital gain), enter the profit amount here.

The CRA says that if you own a business that has a fiscal year end other than December 31, you still have to report the sale of a capital property in the calendar year the sale took place.

If you didn’t have any taxable gains, enter “0”.

As a business owner, you might have to give the occasional discount on a bulk sale or an allowance to your customers for defective or improperly shipped goods and/or unsatisfactory services. You might even have had customers return goods to you that were purchased in error.

Returns, allowances, and discounts are all adjustments to the sales amounts that reduce your gross income and are used to calculate your net business income for the year.

If you haven’t already reduced your gross income by the amount of returns, allowances, and discounts you’ve issued for the year, enter this amount here.

- GST/HST and QST you collected or will collect on your sales, commissions, or fees (if you're using the quick method)

If you’re using the Quick Method way of GST/HST accounting, enter the GST/HST collected or that was collectible on your sales, commissions, or fees.

- GST/HST and QST you remitted to the government (if you're using the quick method)

If you’re using the Quick Method way of GST/HST accounting, the rate at which you remit the GST/HST collected is different and depends on your province and the services or products sold. Enter the amount of GST/HST and provincial tax you submitted to the government.

- Reserves you deducted for this business in your 2019 return

Enter any reserves (such as an amount for a reserve, contingent account, or a sinking fund) that you deducted in the previous year.

- Any income you received from other sources (don't include GST)

Enter any income and its description that you received from other sources such as:

- A recovery of an amount you wrote off as a bad debt in a previous year

- Grants, subsidies, incentives, or assistance you get from a government, government agency, or non-government agency

- The value of vacation trips or other prizes awarded to you because of your business or professional activities

- Payments for land you leased for petroleum or natural gas exploration

- [QC] Other income shown on an RL-27 slip

If you received other income, such as contractual payments or subsidies, enter these amounts in this field. You can find the amount you received on your RL-27 slip.

- Value of your inventory at the start of your fiscal period

Enter the value of the opening inventory. This includes the value of raw materials, goods in process, and finished goods. Your business’ opening inventory is also the closing inventory from the preceding year.

There are two accepted methods for valuing your inventory at the beginning of the year:

- Value your entire inventory at Fair Market Value (FMV). Using this method you can use either the cost you would pay to replace an item or the amount you would receive if you sold the item or

- You can value each item individually either at its FMV or their cost, whichever is less. Cost is the price you incurred for an item and can include any expenses you might incur to bring the item to your business’ location. When you cannot tell the difference between one item and the next, you can then value the items as a group.

- Net amount you paid to purchase goods

The amount of your net purchases during the year are your total purchases minus any discounts you received.

- Value of your inventory at the end of your fiscal period

Using the same method to calculate your opening inventory, enter the closing value of the inventory here. Remember, this amount will be your next year’s opening inventory.

- Your gross professional fees

Your gross sales, commissions, or fees include all sales, whether you received or will receive:

- Money

- Something equivalent to money (such as credit units)

- Something from bartering

Remember to include the GST/HST collected or that was collectible on your gross sales, commissions, or fees.

- Taxable gains you received from the sale of eligible capital property*

If you sold capital property that your business owned and realized a profit (capital gain), enter the profit amount here. The CRA says that if you own a business that has a fiscal year end other than December 31, you still have to report the sale of a capital property in the calendar year the sale took place.

- GST/HST and QST you collected or will collect on your professional fees (if you’re using the quick method)

If you’re using the Quick Method way of GST/HST accounting, enter the GST/HST collected or that was collectible on your sales, commissions, or fees.

- GST/HST and QST tax you remitted to the government (if you're using the quick method)

Since you’re using the Quick Method way of GST/HST accounting, the rate at which you remit the GST/HST collected is different and depends on your province and the services or products sold. Enter the amount of GST/HST and provincial tax you submitted to the government.

- Value of goods/services that weren't completed (work-in-progress) at the start of your fiscal period, if you excluded the amount from your income at the end of your previous fiscal period

Starting March 21, 2017, professionals practicing business (such as accountants, dentists, doctors, lawyers) can no longer use the billed-basis method of accounting. Under billed-basis accounting, you could elect to exclude the value of work-in-progress (WIP) of the business at the end of a tax year from business income for that year, and instead recognize the amounts in income only when the work is billed or billable.

The transition rules currently in place allow you to include your WIP into your income gradually. For the first year that starts after March 21, 2017, you must include 20% of the cost or the fair market value of your WIP, whichever is less. In the second year, this rate increased to 40%, then to 60% in the third year, and 80% in the fourth year. You must include all your WIP in the fifth tax year after March 21, 2017 and for all subsequent tax years.

Important: In H&R Block’s tax software, enter in this field, 100% of your WIP. The software will automatically calculate the amount to be included in your income.

- Reserves you deducted for this business in your 2019 return

Enter any reserves (such as an amount for a reserve, contingent account, or a sinking fund) that you deducted in the previous year.

- Income you received from other sources (don't include GST)

Enter any income and its description that you received from other sources such as:

- A recovery of an amount you wrote off as a bad debt in a previous year

- Grants, subsidies, incentives, or assistance you get from a government, government agency, or non-government agency

- The value of vacation trips or other prizes awarded to you because of your business or professional activities

- Payments for land you leased for petroleum or natural gas exploration

- [QC] Other income shown on an RL-27 slip (if you received one)

If you received other income, such as contractual payments or subsidies, describe your income and enter the income amount. You can find the amount you received on your RL-27 slip.

You'll need to know the percentage of your business' gross income (from sales, advertising, etc.) that was from your business website or webpage. If you're not sure of the exact percentage, enter an estimate on this page.

Enter only the part of these costs that’s related to the business. Don't enter personal expenses.

- Advertising

If you paid for advertising costs to earn business income, you can deduct these expenses. Advertising costs can include ads in Canadian newspapers, Canadian television and radio stations, business cards, and any amounts paid as finder’s fees.

- Meals and Entertainment

If you paid for meals and entertainment to earn business income, you can claim a maximum of 50% of the lesser of the following amounts:

- The amount you paid for the expenses or

- An amount that is reasonable in the circumstances

- Bad debts

A bad debt is money owed to your business that you can’t collect. You can deduct this amount if you’ve determined that an account receivable in the year is bad debt and you’ve already included that amount in the income for the year.

- Commercial insurance premiums

You can deduct commercial insurance costs you incurred on any buildings, machinery, and equipment that is used in your business. To deduct insurance costs for the business use of your motor vehicle, enter these on the Motor Vehicle section of the T2125/TP-80-V page. Insurance costs for the business use of your home can be entered in the Business-use-of-home expenses section.

- Interest paid on money you borrowed for the business

You can deduct interest paid on a loan borrowed for your business or to acquire property for business purposes. There might be limits on the amount of interest you can deduct on money borrowed to buy a vehicle or you can deduct on vacant land.

- Business tax, fees, licenses, dues, memberships and subscriptions

You can deduct annual license fees and business taxes you incurred to run your business, and annual dues or fees for membership in a trade or commercial association. Club memberships for the purpose of recreation are not claimable.

- Office expenses

You can deduct the cost of office supplies such as stationery, stamps, pens, etc. Expenses such as filing cabinets, chairs, desks, and calculators are capital items and can’t be claimed here; instead, claim these expenses in the CCA section.

- Supplies

You can deduct the cost of items your business used indirectly to provide goods or services. For example, if you’re operating a plumbing business, the cost of cleaning supplies can be deducted.

- Legal, accounting and other professional fees

You can deduct costs incurred for professional advice or services, consulting fees, including accounting and legal fees incurred to get advice and help with keeping your records. You can also deduct fees you incurred for preparing and filing your tax and GST/HST returns.

- Management and administration fees

You can deduct management and administration fees, and bank charges incurred to keep your business running. Don’t include rent paid, property taxes, or wages paid here.

- Rent

You can deduct rent paid for the property used in your business. Don’t enter rent related to the business use of your home here; instead, claim that in the Business-use-of-home expenses section.

- Maintenance and repairs (include labour and material costs)

You can deduct the cost of minor repairs or maintenance done on the property used for business purposes. However, you can’t deduct the cost of your own labor, the costs that are capital in nature, or those that have been reimbursed by an insurance company.

- Salaries, wages, and benefits paid to your employees

Gross salaries and other benefits paid to employees can be deducted here. Click this link for information on what not to include in this field.

- Property taxes

You can deduct the property taxes you’ve paid for the property in your business. Don’t enter property taxes related to the business use of your home here; instead, claim in the Business-use-of-home expenses section.

- Travel expenses

Travel expenses you incurred to earn business or professional income can be claimed here and include:

- Public transportation fares

- Hotel accommodations

- Meals

Generally, a 50% limit applies to the cost of meals, beverages, and entertainment when you travel.

- Telephone and utilities

If you paid for expenses such as telephone, gas, oil, electricity, and water to earn business income, you can deduct these costs. Utilities that are related to the business use of your home can’t be claimed here; instead, claim them in the Business-use-of-home expenses section.

Don’t deduct the basic monthly rate of your home telephone. However, you can deduct any long-distance telephone calls you made on your home telephone for your business. If you have a separate telephone for business calls only, you can deduct its basic monthly rate.

- Fuel and lubrication

Enter the cost of fuel such as gas, motor oil, and lubricants used in your business.

Don't include cost of fuel/lubrication used for your motor vehicle here. Enter those costs in the motor vehicle expenses section.

- Delivery, freight, express and messenger services

You can deduct delivery, freight, and express costs you paid for business purposes.

- Allowance on the capital property you’re claiming

You might have bought property for business purposes that does not physically exist (goodwill, licenses, franchises, etc.) but gives you a lasting economic benefit. The full cost of such property can’t be deducted but a portion of the cost can be deducted each year. Click here for more information.

Other expenses – such as the cost of cell phone calls (including costs paid to purchase a package or prepaid air time, as long as these were used for business purposes) and Internet charges (including costs paid to purchase a package or costs billed on a per-usage basis). Additionally, you can deduct the following expenses only if they were paid exclusively for business purposes:

- monthly charge for Internet access

- charges for an Internet connection

- cost of having a cellular telephone licensed or connected

- Amount shown on the Business-use-of-home expenses available to carry forward line on your T2125 from 2019

You might not have used all of your home office expenses last year to reduce your income tax payable. If that is the case, enter the amount from the Business-use-of-home expenses available to carry forward line on your 2019 T2125 form.

- [QC] Amount shown on line 534 on your TP-80-V from 2019 (only enter an amount here if you lived in Québec on December 31, 2020)

You might not have used all of your expenses last year to reduce your income tax payable. Your unused expenses amount can be found on line 534 of your preceding year’s TP-80 form.

- Home office expense

You can deduct a part of the following costs for the business use of your home.

- Heat

- Electricity

- Insurance

- Maintenance

- Mortgage interest

- Property taxes

- Capital cost allowance

- Other expenses

To calculate the portion you can deduct, take the area of your workspace and divide it by the total area of your home.

If you use your home for business and personal purposes, you can use the following formula to calculate the amount you can deduct:

(Hours in the day you used the area for business ÷ 24 hours) X Business portion of your total home expenses

- Did you use part of your home to run a private residential home, tourist home, bed and breakfast, or participating establishment in a hospitality village?

If you used part of your home to operate a private residential home, bed and breakfast, etc., the 50% limit for claiming business-use-of-home expenses does not apply.

You can deduct motor vehicle expenses only when they’re reasonable and you have receipts to support them.

To receive the full benefit of your claim for each vehicle, keep a record of the total kilometres you drive and the kilometres you drive to earn business income. Since only the business portion of your motor vehicle expenses is claimable, you’ll need to enter both numbers for your expenses to calculate correctly.

Note: For each business trip, list the date, destination, purpose, and number of kilometres you drive. Record the odometer reading of the vehicle at the start and end of the fiscal period.

Tip: If you’ve used more than one vehicle for your business, you’ll need to add the mileage and expenses for each vehicle and enter the total of these amounts in the respective fields on this page.

The type of expenses you can deduct are:

- licence and registration fees

- fuel and oil costs

- insurance premiums

- maintenance and repairs

- electricity for zero-emission vehicles

- parking fees for business activities

- supplementary business insurance premiums

- capital cost allowance (enter this on the Capital cost allowance section of the T2125/TP-80 form)

If you use a motor vehicle for business and personal use, you can only deduct the portion of the expenses you paid to earn business income. However, you can deduct the full amount of parking fees related to your business activities and supplementary business insurance for your motor vehicle.

- Is this vehicle a passenger vehicle?

A passenger vehicle is a motor vehicle that is designed to carry people on highways and streets. It seats a driver and no more than eight passengers. Most cars, station wagons, vans, and some pick-up trucks are passenger vehicles.

The following are not considered passenger vehicles: ambulance, bus, taxi, fire emergency-response vehicles, etc.

- Enter the total amount of interest you either need to pay (accrual method) or you paid (cash method) on your loan in your 2020 fiscal period

The accrual method is one where you report your income or expenses in the fiscal period to which they apply, regardless of when you receive the income or paid the expenses. Generally, this is the method most commonly followed by self-employed individuals.

In the cash method, you report income in the fiscal period you received it and deduct expenses in the fiscal period you paid them.

You can’t deduct the cost of property such as furniture, equipment, or a building in the year of purchase. However, as such property wears out over time, you can deduct a portion of its cost each year (generally for as long as you own the property). This deduction is called capital cost allowance (CCA).

- Choose the class for your depreciable property

If you have assets of a business (buildings, equipment, vehicles, etc.), you can claim a yearly deduction on the depreciation on the cost of these assets, also known as CCA. The amount of deduction or CCA you can claim for your depreciable property depends on the class that property belongs to and its CCA rate.

Notes:

-

You can usually claim CCA on only half of your net additions to a class in the year you bought the depreciable property. This is known as the half-year rule.

-

If your asset is a building, the CCA rate is 4%. If you bought a building in Canada after March 18, 2007 that you use for business purposes, you might qualify for an additional allowance, increasing your CCA rate to 10%. To be eligible, you need to use at least 90% of the building for your business. Manufacturing and processing buildings that don’t meet the 90% requirement, will be eligible for an additional 2% allowance (increasing your CCA rate to 6%), if at least 90% of the building is used for non-residential purposes at the end of 2020.

-

- Do you want to claim the CCA for this depreciable property as a partner-level expense? (answer No if you’re claiming the CCA for the partnership)

As a partner in a partnership, you can’t claim CCA for depreciable property that is owned by the partnership. However, if you paid for depreciable property that isn’t owned by the partnership and the cost of which wasn’t reimbursed to you by the partnership, you can claim CCA for it as a partner-level expense.

- If this isn't the first time you're claiming CCA, what was the undepreciated capital cost (UCC) balance for properties in this class at the start of 2020

UCC is equal to the total capital cost of all the depreciable property of the class minus the capital cost allowance (CCA) you claimed in previous years. Enter the UCC for each class at the end of last year.

Skip this field if this is the first year you’re claiming CCA.

- What’s the total cost of additions made to this class in 2020?

If you purchased or made improvements to depreciable property in the year, the CRA considers these to be additions to the class in which the property belongs. Add the total business part of the cost you paid to buy or improve the properties that belong to the same class and enter it in this field.

Click Add another class, to enter the cost of additions for a different class.

- If you disposed of a property in this class in your 2020 fiscal period, what were your proceeds of disposition? Enter the lowest amount: the amount you received for the property or the capital cost

Also, include any insurance proceeds for a property that was lost or destroyed that are more than the cost of the property, you will have a capital gain and possibly a recapture of CCA.

- Do you want to claim less than the maximum amount of CCA you can claim this year?

You don’t have to claim the maximum amount of CCA for the year; you can claim any amount that’s less than the maximum allowed. When you claim CCA, it reduces the balance of the class by the amount you’ve claimed, so you have less to CCA to claim in future years. For example, if you don’t have to pay income tax for 2020, you might not want to claim CCA for the year.

- How much of the amount you entered in the previous field is for additions for accelerated investment incentive properties (AIIPs) that were acquired after November 20, 2018? The new property must be available to use before 2024

Under the Accelerated Investment Incentive measure, certain capital property that is subject to the general CCA rules (referred to as eligible property) will be eligible for an enhanced first-year allowance, provided it is acquired after November 20, 2018. The new property must be available for use before 2028. With this measure, eligible property that was:

- subject to the half-year rule will now qualify for an enhanced CCA that is equal to three times the normal first-year deduction

- not subject to the half-year rule will qualify for one and a half times the first-year deduction

Note: The Accelerated Investment Incentive measure doesn’t change the total amount that’s deductible over the life of a property. You’ll simply be claiming a larger CCA deduction in the first year and smaller CCA deductions in future years.

An additional capital cost allowance of 35% was introduced for Québec businesses that bought new qualified property after March 28, 2017 but before April 1,

- machinery and equipment bought mainly with a view to using them for manufacturing and processing goods intended for sale or lease

- general-purpose electronic data processing equipment and systems software for that equipment

You must put the qualified property to use within a reasonable time after it was bought, and it must be used mainly for the purpose of carrying on a business during a period of 730 consecutive days following the day it was first used. It must also be used mainly in Québec throughout the 730-day period.