RRSP Contributions and HBP or LLP repayments

The RRSP contributions and HBP or LLP repayments (Schedule 7) page is used to report your contributions to a registered retirement savings plan (RRSP). Your RRSP contributions impact your taxes in two ways:

- they reduce your tax payable (when you claim the RRSP deduction on your return)

- the income you earn in the RRSP is tax-exempt as long as the money remains in the plan

Example, if your RRSP contribution limit for the year is $10,000 and you put the full amount in your RRSP, you can subtract the $10,000 from your income when you file your taxes. This means you don’t have to pay tax on your contribution amount. Additionally, unlike with regular investments, your RRSP contributions are tax sheltered, meaning it grows tax-free. However, you will have to pay tax on the money you withdraw from an RRSP (usually once you retire).

You’ll also need to complete this page if any of the following situations applied to you in 2020:

- You withdrew money from your RRSP for the Home Buyer’s Plan (HBP) to pay for your new home or are repaying the RRSP funds you withdrew under the HBP

- You withdrew money from your RRSP or the Lifelong Learning Plan (LLP) to pay for education or training for yourself or your spouse or are repaying RRSP funds you withdrew under the LLP

- You aren’t deducting all your unused RRSP/PRPP contributions on your return (i.e. amount (B) on your latest notice of assessment or reassessment)

- You aren’t deducting all the RRSP/PRPP contributions you made from March 2, 2020 to March 1, 2021 on your return

- You’re applying your RRSP/PRPP contributions as a current year repayment under the HBP or LLP

- You’ve transferred certain amounts you included in your income to your RRSP/PRPP or

- You’ll be the beneficiary of income contributed to an amateur athlete trust in the year and you want that income to be used in calculating your RRSP/PRPP contribution limit

Notes:

- If you want to report your pooled registered pension plan (PRPP) contributions, you can do so on the Employer or employee contributions to a PRPP or VRSP page under the PENSION PLANS AND INVESTMENTS icon on the PREPARE tab.

- If you’re a Québec resident and you’re repaying RRSP funds that you withdrew under the HBP or the LLP, you’ll also need to complete the TP-935.3-V: Repayment of RRSP Funds Withdrawn Under the Home Buyers' Plan or the Lifelong Learning Plan. Fortunately, the TP-935.3-V and the RRSP contributions and HBP or LLP repayments pages are combined in H&R Block’s tax software.

When completing your return, you’ll be asked to indicate when you made your contributions:

- Between March 2 and December 31 of the current tax year or

- Between January 1 and March 1 of the current calendar year

For example, let’s say you’re filing your 2020 tax return. You’ll need to specify how much you contributed to your (or your spouse’s or common-law partner’s) RRSP between March 2 and December 31, 2020 as well as the amount you contributed between January 1 and March 1, 2021. You can find this information on your RRSP contribution receipt (see section below).

If your contributions are more than your RRSP deduction limit, the Canada Revenue Agency (CRA) won’t allow the contributions you’ve made between January 1 and March 1, 2021.

Once you’ve reported your RRSP contributions on this page in H&R Block’s tax software, you’ll be able to choose how much you want to claim this year on the Your 2020 income page under the OPTIMIZATION icon on the WRAP-UP tab. Any RRSP contributions that you don’t claim a deduction for this year, will be carried forward for use in a future year. Refer to the What is the RRSP deduction limit and how much should I claim? section below for more information.

You’ll need the information on your RRSP contribution receipt(s) to claim a deduction for the RRSP contributions you made during the year. The issuer of your RRSP (the financial institution such as your bank, credit union, trust, or insurance company with whom you set up your RRSP) will send you a receipt showing how much you or your spouse contributed to the RRSP from March 2, 2020 to December 31, 2020. If you also made RRSP contributions in the first 60 days of 2021, you’ll get a separate RRSP contribution receipt for that period.

If you haven't received a receipt for your RRSP contributions, contact the issuer of your RRSP to obtain a copy.

Your RRSP deduction limit represents the maximum amount you can deduct from your taxes in any given year. You can find your RRSP deduction limit for the year on:

- Your notice of assessment (NOA)

- Your T1028: Your RRSP Information (in some cases, the CRA will send this to you once they’ve processed your previous year’s return)

- My Account (registration required)

- MyCRA (CRA’s mobile app) or

- Contact TIPS (Tax Information Phone Service) 1-800-267-6999

It’s up to you to decide how much of your contributions you’d like to deduct on your return. You can claim all or a portion of your RRSP contributions, as long as it isn’t more than your RRSP deduction limit for the year. If your RRSP contributions for the year were more than your RRSP deduction limit, you’ll be able to carry forward the amount you couldn’t claim this year.

Tax Tip: It’s generally recommended that you deduct just enough of your RRSP contributions so that your tax owing is zero; this will maximize the amount that you can carry forward for use in a future year.

Once you’ve reported your RRSP contributions on this page in H&R Block’s tax software, you’ll be able to choose how much you want to claim on your 2020 return on the Your 2020 income page under the OPTIMIZATION icon on the WRAP-UP tab.

If you decide to:

- Deduct the maximum allowable amount (RRSP deduction limit), then on the Your 2020 income page, select Yes in response to the following question: You entered {$} of RRSP contributions in your return. You can claim these contributions this year or carry forward some or all of them to use next year. Do you want to claim the maximum amount of contributions you can claim this year?.

- Deduct only a portion of your contributions, you can carry forward the remaining amount for use in a future year. To do this, on the Your 2020 income page:

- Select No in response to You entered {$} of RRSP contributions in your return. You can claim these contributions this year or carry forward some or all of them to use next year. Do you want to claim the maximum amount of contributions you can claim this year?.

- Enter the amount of RRSP contributions you want to claim this year. Any remaining amount will automatically be carried forward.

If you have an RRSP contribution dated Jan or Feb 2020 that you didn’t report in your 2019 tax return (either as a contribution or as a carry-forward amount), you can’t apply it to your 2020 return UNTIL you have adjusted your 2019 tax return. You have two options:

- You can use the amount as a deduction on your 2019 return, or

- You can carry it forward to use it as deduction on your 2020 return

Either way, you have to adjust your 2019 tax return to indicate your choice and wait for the 2019 tax return adjustment to be processed by the CRA, before you can add the amount to your 2020 return.

If you made contributions in an earlier year and didn’t claim them on your previous year’s return, you can complete the RRSP contributions and HBP or LLP repayments page and request an adjustment to your return for that year with a T1 Adjustment form. By doing so, you’ll avoid having your deduction reduced or disallowed for contributions made.

Yes. However, you should be aware that when you contribute to your spouse’s RRSP, it will lower your RRSP deduction limit.

Example:

Karen has an RRSP deduction limit of $10,000 in 2020. She contributes $6,500 to her RRSP and $3,500 to her spouse’s. While Karen’s contribution to her spouse’s RRSP lowers her deduction limit by $3,500, Karen is entitled to claim a deduction for the contributions she’s made to both her and her spouse’s RRSP.

The issuer of your RRSP will send you a receipt showing how much you or your spouse contributed to the RRSP over the course of the year. If you’re expecting a receipt and didn’t get one, contact the company that issued you your RRSP.

As long as you’ve got contribution room, you can transfer certain amounts (like a retiring allowance, amounts paid from an RRSP or RRIF upon death of the annuitant, RPP lump sum, etc.) you received during the year either directly or indirectly into your RRSP.

A direct transfer means that the funds (which are considered taxable income) are contributed to your RRSP without being taxed. An indirect transfer means that the amounts that you’re transferring have been paid out to you and you need to make the RRSP contribution yourself.

For example, a direct transfer to an RRSP or RPP of an eligible retiring allowance (like severance pay) will not have income tax withheld at source. If, however, you physically receive the funds and then use them to make a contribution to your RRSP (an indirect transfer) they will be taxed. For more information, refer to the CRA’s guide, RRSPs and Other Registered Plans for Retirement.

Depending on your situation, the amount you’re allowed to transfer to your RRSP will vary. For example, you can only transfer the eligible part of your retiring allowance to your own RRSP (or SPP, RPP, or PRPP). As a rule, the eligible part you’re allowed to transfer is $2,000 for each year or part-year of servicebefore 1996 in which you worked for the employer (or a person related to the employer) that paid you the retiring allowance.

For 2020, the eligible part of your retiring allowance can be found in box 66 of your T4 slip (an amount in box 67 represents the part that isn’t eligible for transfer). For more information on transferring this, or other types of property to your RRSP, refer to the CRA’s guide, RRSPs and Other Registered Plans for Retirement.

When you withdraw an amount from your RRSP to certify a PSPA, your RRSP contribution room for the next year is reduced by the PSPA amount.

A PSPA only happens under a defined benefit provision of a registered pension plan (RPP) and occurs when your benefits increase. This increase might happen if you are credited with additional pensionable service and want a pension buyback or when the benefits you earned previously are upgraded. In both cases, the employment period must have been after 1989.

You can find your net PSPA for a previous year on that year’s notice of assessment or reassessment, or in your CRA My Account.

Refer to your T4A and/or T4RSP slip for the amounts you’re designating as a qualified withdrawal.

You can set up an RRSP through different types of financial institutions including your bank, credit union, trust, or insurance company. The issuer’s (the person or institution with whom you opened the RRSP) responsibilities include registering the plan, receiving the amounts that you contribute, and trading the securities that are held within the plan on your behalf.

Follow these steps in H&R Block’s 2020 tax software:

Note: If you’re a resident of Québec, H&R Block’s tax software will use the information you enter on your federal RRSP contributions and HBP or LLP repayments (Schedule 7) page, in your Revenu Québec return.

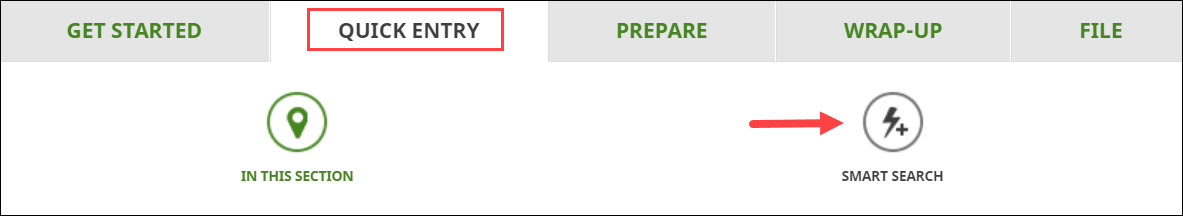

- Type RRSP contribution receipt in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the RRSP contributions and HBP or LLP repayments page, enter your information into the tax software.

Important: Once you’ve reported your RRSP contributions on this page, you’ll be able to choose the amount of contributions you want to claim on your return on the Your 2020 income page under the OPTIMIZATION icon on the WRAP-UP tab. If you don't claim all of your RRSP contributions for the year, the remaining amount will be carried forward for use in a future year.

Follow these steps in H&R Block’s 2020 tax software:

- Type Home Buyer’s Plan (HBP) repayment amount or Lifelong Learning Plan (LLP) repayment amount in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the RRSP contributions and HBP or LLP repayments page, under the Your Home Buyer’s Plan or Lifelong Learning Plan heading, you’ll be able to indicate if you’ve taken money out under the HBP or the LLP and if you need to repay some of that amount this year.