Repayments to the Lifelong Learning Plan (LLP)

With the Lifelong Learning Plan (LLP), you can use your registered retirement savings plan (RRSP) to help pay for education or training if you or your spouse or common-law partner would like to further your studies. Under the LLP you can withdraw up to $10,000 per year (up to a total of $20,000) from your RRSP to pay for full-time training or education for you or your spouse.

When the time comes for you to pay back the money you’ve withdrawn under the LLP, you’ll need to report your repayments on your tax return. You have 10 years to repay what you’ve withdrawn. You usually have to repay at least 1/10 of the amount you withdrew each year until it is fully repaid.

You can participate in the LLP if you meet all the following conditions:

- You’re the owner of an RRSP

- You’re a resident of Canada

- You’ve enrolled, or received an offer to enroll, in a qualifying program at an educational institution as a full-time student before March of next year

- If you’ve made an LLP withdrawal in a previous year, your repayment period must not have begun

Note: You can enroll as a part-time student and use the LLP if you have a mental or physical disability that keeps you from studying full-time and you’ve submitted a signed letter from a medical practitioner to this effect, or you qualify for the disability amount for the year of the LLP withdrawal.

You can’t participate in an LLP:

- if you’ve already completed your program and are no longer enrolled

- to help pay for your or your spouse's children’s education or training

Yes. Under the LLP you can withdraw up to $10,000 per year (up to a total of $20,000) from your RRSP to pay for full-time training or education for you or your spouse or common-law partner.

In order to participate in the program, you or your spouse must meet all of the following conditions:

- You have an RRSP

- You’re a resident of Canada

- You or your spouse is enrolled (or has received an offer to enroll before March of the following year):

- as a full-time student*

- in a qualifying educational program and

- at a designated educational institution

- If you made an LLP withdrawal in a previous year, your repayment period must not have begun

*Note: If the LLP student meets one of the disability conditions, he or she can be enrolled as a part-time student.

If any of the above conditions is not met while you’re participating in the program, your RRSP withdrawal won’t be considered eligible and you’ll need to include the withdrawal amount as income on your return for the year you received the funds. Remember, you can’t participate in the LLP if your spouse has already completed the program.

If you withdraw more from your RRSP than the established annual limits, the overage will be added to your income in 2020 and you’ll have to pay tax on it.

Under the LLP, you’re allowed to withdraw up to $10,000 from your RRSPs each calendar year to help you cover the costs of enrolling in a post-secondary program, with a maximum of $20,000 each time you participate in an LLP. Your yearly limit amount of $10,000 is known as your annual LLP limit, and it’s not limited to the amount of tuition or other education expenses you might have. Your maximum LLP withdrawal amount of $20,000 is known as your total LLP limit.

If you withdraw more than the annual LLP limit, the excess amount will be added to your income for the year of the withdrawal, but it won’t reduce your total LLP limit of $20,000.

Remember, you can participate in the LLP again, beginning in the year after you bring your LLP balance to zero. For more information, refer to the Canada Revenue Agency (CRA) website.

Note: Your spouse or common-law partner (if applicable) can also withdraw $10,000 from their RRSPs under the LLP in the same year you do.

The Canada Revenue Agency (CRA) determines when your repayment period will start by checking if you’re a qualifying student for at least three months during the year. If you meet this condition every year, your repayment period will start in the fifth year after your first LLP withdrawal. If you don’t meet this condition for two years in a row, your repayment period will start in the second year of the two years checked by the CRA.

To repay the amount you’ve withdrawn from the LLP, you’ll need to contribute what you owe for the year to any of your RRSP or PRPP accounts. Make sure you specify that your contribution is an LLP repayment so it won’t be treated like a regular RRSP or PRPP contribution. If you don’t contribute to your pension plan, you’ll need to add the amount you should have repaid to your income. You have 10 years to repay what you’ve withdrawn.

The CRA will send you an LLP statement of account with your notice of assessment (NOA) or reassessment, which includes:

- Your total withdrawals (you can also find this amount on your T4RSP slip for each year you withdrew amounts under the LLP)

- How much you’ve repaid so far (including any additional payments and what you’ve included on your tax return because it wasn’t repaid)

- Your remaining balance

- What you need to contribute to your RRSP or pooled registered pension plan (PRPP) as repayment for next year

Even though the CRA requires that you pay back a minimum amount of your LLP balance over the course of 10 years, you can choose how much of your RRSP contributions you’d like to use to pay down your balance. If you pay back more than the amount you’re required to pay back for the year, the amount you’ll have to pay in each of the following years will be less. The LLP Statement of Account sent with your NOA will take into account any additional payments you make and will tell you how much you’ll need to repay next year.

Visit the CRA website for more information on repayments.

If you had to leave the program before April of the year after the withdrawal, you’ll still be able to make repayments to your RRSP over the 10-year period if less than 75% of your tuition cost is refundable by the educational institution you attended. If, however, 75% or more of your tuition is refundable, you’ll need to cancel your LLP withdrawal. If you don’t formally cancel your LLP withdrawal, the entire amount you withdrew from your RRSP will be included in your income for the year you withdrew it.

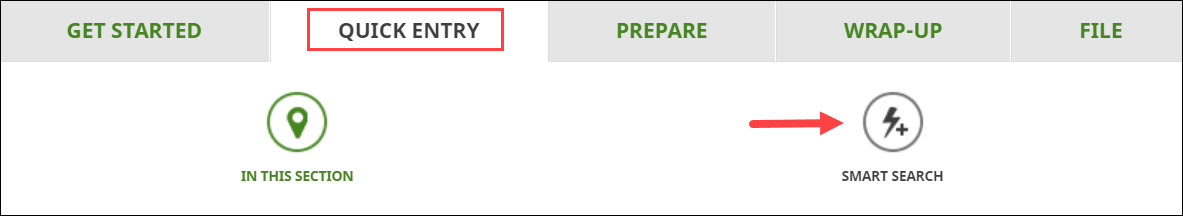

Follow these steps in H&R Block’s 2020 tax software:

- Type Lifelong Learning Plan (LLP) repayment amount in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your RRSP contributions and HBP or LLP repayments, under the Your Home Buyer’s Plan or Lifelong Learning Plan heading, select Yes to the question: Have you taken money out of your RRSP to pay for education or training, under the Lifelong Learning Plan (LLP), and do you want or need to repay some of that amount this year?

- Enter your information into the tax software.