Jump start my return: Transfer your 2019 information into your 2020 return

If you used H&R Block’s tax software last year to prepare your return, you can jump start your return to transfer your personal information and carry forward amounts (such as your HBP/LLP amounts, unused tuition amounts, certain provincial tax credit amounts, and more) from your 2019 return directly into your 2020 return – saving you time!

If you don’t want to transfer your 2019 information into your 2020 return, don’t worry – you can use the information on your latest notice of assessment (NOA) or notice of reassessment to complete your 2020 return.

Before you begin, you’ll need to log into H&R Block’s 2020 tax software using the same account (username/email ID) that you used last year. If you’ve forgotten the username or password, refer to our help centre article on how to retrieve or reset these.

Once you log into H&R Block’s 2020 tax software, follow these steps:

-

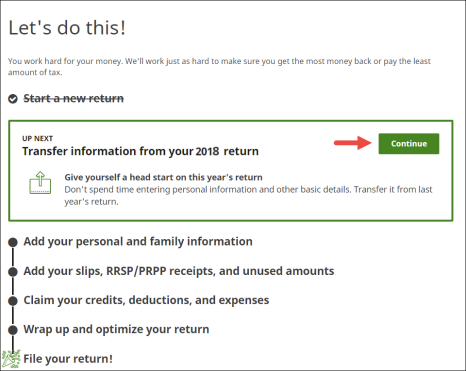

On the Let’s do this! page, click Continue

in the Transfer information from your 2019 return box.

-

Select the return(s) you want to transfer and click

Continue.

-

You’ll be able to see all the information that was transferred from your

2019 tax return.

Note: If you want to change any of the information that was transferred from your 2019 return, you’ll be able to do so as you complete your 2020.

- Click the Continue button at the bottom of the screen to start your 2020 return.

If you created an account last year but didn’t file your return through the H&R Block tax software, you'll need to create a new return and enter your information manually.

Absolutely! If you used H&R Block’s tax software last year and you want to transfer your information directly into this year’s return, all you need to do is follow the steps outlined in the section above.