How do I create my account?

New to H&R Block’s DIY tax software? In a few simple steps, you can create an account to complete your 2020 tax return quickly and securely.

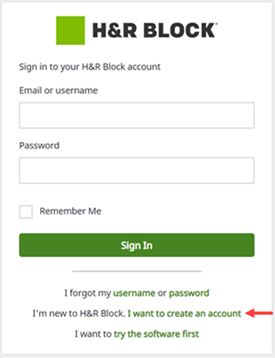

To start, go to H&R Block’s 2020 tax software’s home page - https://2020.hrblockonline.ca/#/login. Then follow these steps to create your account:

- Click the I want to create an account link.

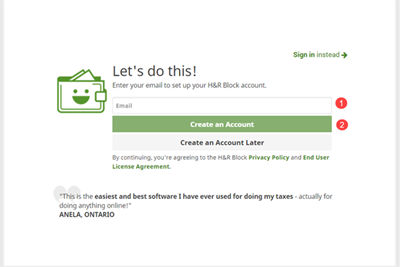

- Enter the email address you want to use for your H&R Block account and click Let’s Go.

Note: The email you provide will be your username for your H&R Block account. It is best to use an email address that you access regularly.

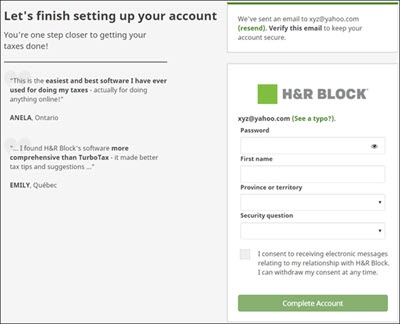

- Finish setting up your account by creating your password and entering information in the fields provided, then click the Complete Account button.

Note: The Security question hint can't be the same as your Security question answer.

- That’s it! Click Start Your 2020 Return to get your taxes done.

Notes:

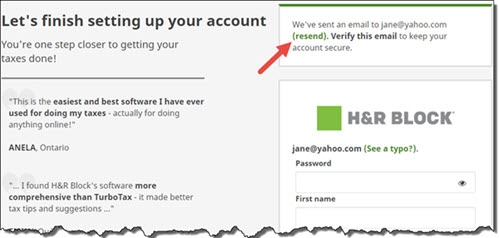

- When you enter your email to sign up for H&R Block’s 2020 tax software, you’ll receive a verification email at the email address you provided.

- To keep your account secure, click the Verify Your Email Now button in the email and confirm this email address belongs to you.

- If you do not see the verification email in your email Inbox, check your Spam or Junk folder. If you do not receive the verification email within 5 minutes of providing your email address, click the resend link here.

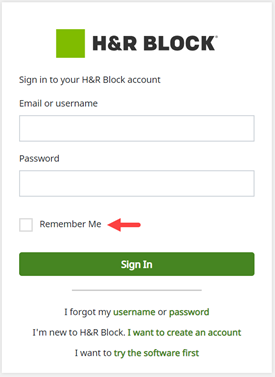

- Click the Remember Me checkbox if you don’t want to enter your username and password next time you login from the same computer.

If you’re a returning user, you don’t need to create a new account. Simply log into the H&R Block’s 2020 tax software with your existing username and password. If you’ve forgotten your username or password, refer to our online help centre article, How do I sign in?, for information on how to recover these.

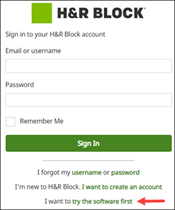

Not sure if H&R Block’s 2020 tax software is the one for you? Don’t worry, you can try it out now without creating an account! Here’s how:

- On the Sign In page of the tax software, click the I want to try the software first link.

- In the Before you get started window, click I Agree to agree to the H&R Block Privacy Policy and End User License Agreement.

- On the Welcome! page, click Start Your 2020 Return.

- Select how you filed your taxes last year and click Continue.

- If you selected:

- I used TurboTax, UFile, or SimpleTax, you’ll find yourself on the What’s next page. Click Continue in the Add your personal and family information box to start entering information in your 2020 tax return (or you can import a PDF of your tax return from one of these software).

- I’ve never filed my taxes before or I used another method, you’ll find yourself on the What’s next page. Click Continue in the Add your personal and family information box to start entering information in your 2020 tax return.

- I used H&R Block Tax Software, you’ll need to sign into your existing H&R Block account that you used to file your return last year. You’ll then find yourself on the Let’s do this! page. Click Continue in the Transfer information from your 2018 return box and select the return(s) you want to transfer (or you can choose to start a new blank return). Then, click Continue.

Note: If you’ve forgotten your username or password, refer to our help article for more information on how to retrieve these.

- You can now review, edit, and enter information in your 2020 tax return. That’s all there is to it!

Notes:

- You won’t be able to save and exit your return until you’ve created an account.

- We care about your security! If you’re trying the software without an account, be sure not to leave the software inactive for more than 20 minutes. The software will terminate your session and delete your information after 20 minutes of inactivity.

- Before you can file your return with H&R Block’s 2020 tax software, you’ll need to create an account.

- You’ll be able to access Support or the option to upgrade your software package once you’ve created an account.