Schedule M: Interest Paid on a Student Loan

You can claim a non-refundable tax credit for the interest you or a relative paid on your student loans on Schedule M of your tax return.

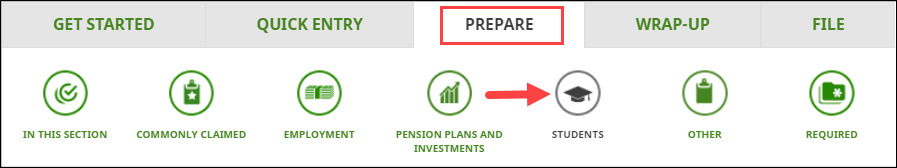

Note: Schedule M and the corresponding federal form are combined in H&R Block’s tax software. You can add your federal and provincial interest amounts and enter the combined total in the relevant field on the Interest paid on a government student loan page under the STUDENTS icon on the PREPARE tab.

You can claim this tax credit if the interest on your student loans was paid after 2000 and you received your loan under:

- The Act respecting financial assistance for education expenses

- The Canada Student Loans Act

- The Canada Student Financial Assistance Act

- The Apprentice Loans Act

- A law of province other than Québec governing the granting of financial assistance to post-secondary students

Note: Interest paid on any other type of loan (such as a line of credit), or a student loan combined with another type of loan can’t be claimed.

Remember, whether it was you or someone else who paid the interest on your student loans, only you can claim the tax credit.

You can also use Schedule M to calculate the amount for interest paid on a student loan that can be carried forward to a future year. Even if you’re not going to claim the tax credit this year, you should complete Schedule M so you know how much interest you can carry forward later.

Refer to line 62 your Schedule M from last year, your Notice of Assessment (NOA), or your Notice of Reassessment to determine the amount of unused interest you can claim.

Note: You can enter and claim your unused student loan interest amounts paid between 2000 and 2019 on the Interest paid on a government student loan page in H&R Block’s tax software.

If you paid interest on your student loans after 2000 but didn’t calculate your carry forward amount last year, you’ll need to enter the result of the following calculation into H&R Block’s tax software:

Interest you paid between 2000 and 2019 minus the interest you’ve already used to claim this credit in the past

For example, let’s say that between 2000 and 2019, you paid $2,400 in interest on your student loans. During that time, you claimed just $2,100 of the total interest you paid on your tax returns. In 2020, you’d be able to claim the remaining $300 in interest ($2,400 - $2,100) on your return.

Follow these steps in H&R Block’s 2020 tax software:

Before you begin, make sure that you’ve told us you lived in Québec on December 31, 2020.

- Under the PREPARE tab, click the IN THIS SECTION icon.

- In the Unused tuition amounts and student loans box, click the Add This Topic button.

- Click the STUDENTS icon. You'll find yourself here:

- Under the CREDIT AMOUNTS heading, select the checkbox labelled Interest paid on a government student loan.

- When you arrive at the Student loan interest page, enter your information into the tax software.