Schedule K: Premium Payable Under the Québec Prescription Drug Insurance Plan

If, in 2020, you had a health insurance card that was issued by RAMQ, you have to be covered by one of the following plans:

- a group insurance plan, if you’re eligible for it

- Québec's public prescription drug insurance plan (RAMQ), if you’re not eligible for a group insurance plan

If you’re not eligible for a group insurance plan, you must participate in the Québec prescription drug insurance plan by paying a premium when you file your tax return. Your premiums are calculated on the Schedule K form.

Note: By completing the Schedule K form, you aren't automatically registered for the Québec prescription drug insurance plan. If you want to register for the plan, refer to the RAMQ website.

If you’re eligible for a group insurance plan, you’re required to join that plan. If you don’t, you must still pay premiums for the Québec prescription drug insurance plan, but you won’t be allowed to receive any benefits under it because you were required to be a member of the group insurance plan that was available to you.

You also have an obligation to make sure your spouse has prescription drug coverage unless they’re eligible for their own group insurance plan. If neither of you qualify for other insurance plans, then you must join the Québec prescription drug insurance plan.

The maximum premium you’ll be responsible for is $642 (per spouse, if you’re a couple).

Note: If you weren’t covered under the Québec prescription drug insurance plan (RAMQ) in 2020, you can’t pay your spouse’s premiums for them on your return. In order to do so, both you and your spouse must have been covered under the Québec prescription drug insurance.

There are a number of scenarios where you won’t have to pay the premium, all of which are listed on the Revenu Québec website.

For example, you won’t need to pay the premium if:

- you are over the age of 65 (born before January 1, 1955)

- you had a spouse throughout the year who was also born before January 1, 1955

- your net federal supplements (as seen on line 148 of your Québec return) were more than $6,261 and

- you received free medications throughout the year because you received Guaranteed Income Supplement

Note: To find line 148 on your Québec return, you’ll need to download your PDF tax summary once you’ve entered all your information slips, receipts, and claimed deductions and credits. For more information, refer to our help article Where do I find my PDF tax return?.

As you complete Schedule K in H&R Block’s tax software, you might have to indicate which months a particular situation applied to you for at least one day in 2020. By indicating which month these situations applied to you during the year, you’re identifying which months you were exempt from the Québec Drug Insurance Plan. For example, if you select I had a functional impairment that started before I turned 18, and you indicate that this applied to you from January to April, you will not have to pay the premium for those four months.

Notes:

- If you’re a beneficiary under the James Bay and Northern Québec Agreement or the Northeastern Québec Agreement, you’re not covered by the Québec prescription drug insurance plan because you’re covered by an equivalent plan administered by another Québec Act or government.

- A valid claim slip is issued by the Ministère du Travail, de l'Emploi, de la Solidarité sociale (MTESS) to recipients of last-resort financial assistance and, in some cases, to adults or families who aren’t. If you’ve received a valid claim slip from MTESS, you’re eligible to register for Québec’s public prescription drug insurance plan and you can obtain certain prescribed drugs and certain services, like eye exams and dental care. You won’t have to pay the premium because you receive your benefits at no cost to you.

If you suffer from a functional impairment you might not have to pay a premium under the Québec Drug Insurance Program if:

- the impairment started before you turned 18

- you live with your parent(s)

- you aren’t married or have a common-law partner

- you aren’t receiving benefits under a last resort financial assistance program

- you have a document from Régie de l’assurance maladie du Québec (RAMQ) that confirms your impairment

According to the government of Québec, a person has a functional impairment if they have:

- an intellectual impairment, with an intelligence quotient (IQ) of less than 70, as determined through standardized testing

- a severe permanent psychiatric, organic*, or motor impairment which, in spite of technological assistance (in the case of motor impairment) prevents them from carrying out normal day-to-day activities

- a severe, permanent multiple impairment, with 2 or more of the following impairments that combine to prevent them from carrying out normal day-to-day activities:

- intellectual impairment

- psychiatric impairment

- organic impairment

- motor impairment

- speech or language impairment

- hearing impairment (as determined by a hearing test where the person has an acuity threshold of 40 decibels or more at a frequency of 500, 1,000, and 2,000 hertz in the ear that has the best hearing capability)

- visual impairment (after correction through the use of the appropriate lenses) that’s characterized by visual acuity in each eye of not more than 6/21 or by a field of vision in each eye that is less than 60° in the 180° and 90° meridians or that requires the use of special optical systems of over +4.00 dioptres

*An organic impairment refers to the decrease in mental function due to a physical disease rather than a psychiatric illness.

Note: A functional impairment must be certified by a health professional.

If you were a full-time student, you’ll need to select all 12 months for certain situations, including if you:

- Were at least 18 but under the age of 26

- Didn’t have a spouse

- Were a dependant of your parent(s) and lived with them

- Were registered for the Québec prescription drug insurance plan by your parent(s) and

- Attended secondary school, college, or university full-time during the fall or winter semesters (regardless of whether or not you were enrolled during the summer)

If you weren’t registered during the fall and winter semesters, you’ll need to select the months (complete or not) included in the period you were a full-time student. If you attended school-part time because of an impairment, contact Revenu Québec to find out what rules apply to your situation.

Note: For the purposes of this plan, a spouse means someone you’re living with in a conjugal relationship throughout the 12 months of the year.

If none of the situations listed on the Schedule K apply to you and you were in one of the following “other specific situations”, you don’t have to pay the Québec prescription drug insurance plan premium:

- You were at least 65 and want to pay for your spouse's premium provided:

- Your spouse is between the ages of 60 and 65, your net federal supplements (line 148) were more than $5,778, and the total of your monthly Guaranteed Income Supplement (GIS) payments is at least 94% of the maximum for the year (without the top-up benefit)

- Your spouse is at least 60, your net federal supplements were more than $9,751, and the total of your monthly Guaranteed Income Supplement (GIS) payments is at least 94% of the maximum for the year (without the top-up benefit)

- You lived in a province other than Québec but had a business in Québec

- You temporarily lived outside of Québec throughout the year

- You’re a foreign national and aren’t entitled to be reimbursed for your prescription drug costs under the Québec prescription drug insurance plan

- You’re a French national temporarily living in Québec under the Protocole d'entente Québec-France and you were a full-time student at a school recognized by the Ministère de l'Éducation, de l'Enseignement supérieur

- You’re a French national temporarily living in Québec under the Entente entre le Québec et la France and you worked (for pay or otherwise) while subject to French law

- You’re a Belgian national temporarily living in Québec under the Entente entre le Québec et la Belgique and you were a full-time student at a school recognized by Ministère de l'Éducation, de l'Énseignement supérieur

- You’re a Belgian national temporarily living in Québec under the Entente entre le Québec et la Belgique and you worked as a detached worker or as a self-employed person while subject to Belgian law

However, if you’re in any of these situations, you’ll need to contact Revenu Québec to find out which rules apply to you:

- You became a resident of another province in 2020

- You were a resident of Québec on December 31, 2020, but you were also a resident of another province during the year

- You’re an immigrant or emigrant

- You stopped receiving coverage under the Québec prescription drug insurance plan in 2020(this would happen if, for example, you were outside of Québec for over 183 days)

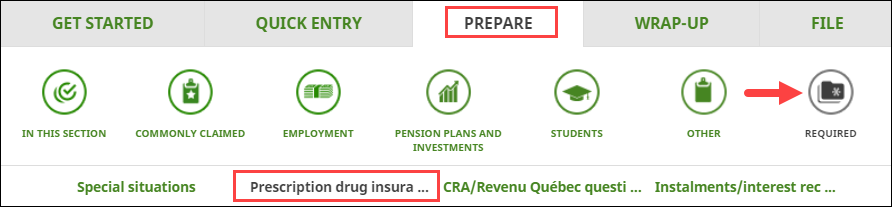

Follow these steps in H&R Block’s 2020 tax software:

Before you begin, make sure you tell us that you lived in Québec on December 31, 2020.