Relevé 23: Recognition of volunteer respite services (RL-23)

You’ll receive a Relevé 23 (RL-23) slip if, during the year, you provided volunteer respite services to a caregiver who’s been taking care of a family member suffering from a long-term disability.

In order to receive an RL-23 slip, the services you provide must:

- Be unpaid (on a voluntary basis)

- Take place in the recipient’s home, and

- Equal at least 400 hours

In addition to meeting the conditions listed above, you must also have been a resident of Québec on December 31 of the tax year covered by the claim. If you’ve met all the conditions and you were issued an RL-23 slip, the credit amount that you can claim on your return will be located in box C of your slip.

Unfortunately, if you didn’t provide at least 400 hours of respite services during the year, you can’t claim this credit.

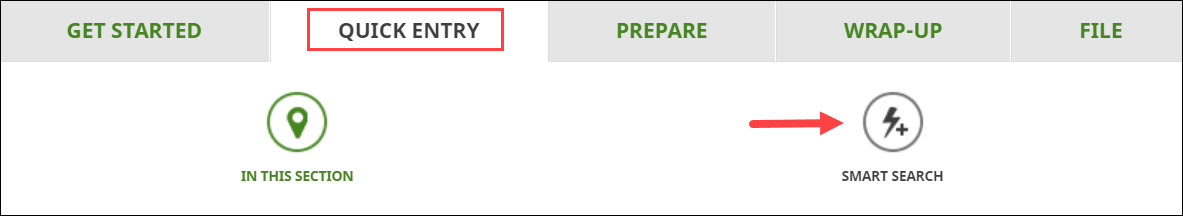

Follow these steps in H&R Block's 2020 tax software:

- Type RL-23 or relevé 23 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your RL-23, enter your information into the tax software.