Relevé 1: Employment and other income (RL-1)

You’ll receive a Relevé 1: Employment and other income (RL-1) from each Québec-based employer you worked for during the year. This slip shows your income as well as any amounts deducted from it, including income tax, QPP contributions, and union dues.

Important: Your employer will also issue you a T4: Statement of remuneration paid slip, which is the RL-1’s corresponding federal slip. You’ll need to enter the information from both slips into H&R Block’s 2020 tax software when preparing your return.

If at any time during the year you worked in Québec, you will receive a T4 and an RL-1 slip for the income you received from your Québec-based employer. Be sure to enter both slips into H&R Block’s tax software to correctly calculate your tax payable or refund.

Even if you didn’t live or work in Québec during the year, you will receive a T4 and an RL-1 slip if you worked for a Québec-based employer and you got paid by the establishment from within Québec. For example, let’s say you live in Ontario and work from home for a company located in Québec. Since this company pays you from their establishment in Québec, they are required to issue a T4 and an RL-1 slip to you. You must enter both slips into H&R Block’s tax software to correctly calculate your tax payable or refund.

If you lived in Québec but worked in another province, you might receive the following:

- A T4 slip with no RL-1 slip – This might be the case if your employer doesn’t have an office in Québec.

- A T4 slip and an RL-1 slip – You’ll receive an RL-1 slip even if you worked in another province if your employer contributed towards your private health insurance plan (amounts in box A and/or box J). Since this is taxable income, your employer must issue an RL-1 slip to you.

If you received a T4 slip and an RL-1 slip, be sure to enter information from both slips into H&R Block’s tax software to correctly calculate your tax payable or refund.

Since federal and Québec income taxes are calculated differently, certain amounts on your T4 and RL-1 slips might not be the same. For example, employer contributions to private health insurance plans are considered taxable income in Québec and are included in the employment income amount on the RL-1 slip. That is not the case federally. Be sure to enter amounts from both your T4 and RL-1 slips into H&R Block’s tax software to correctly calculate your tax payable or refund.

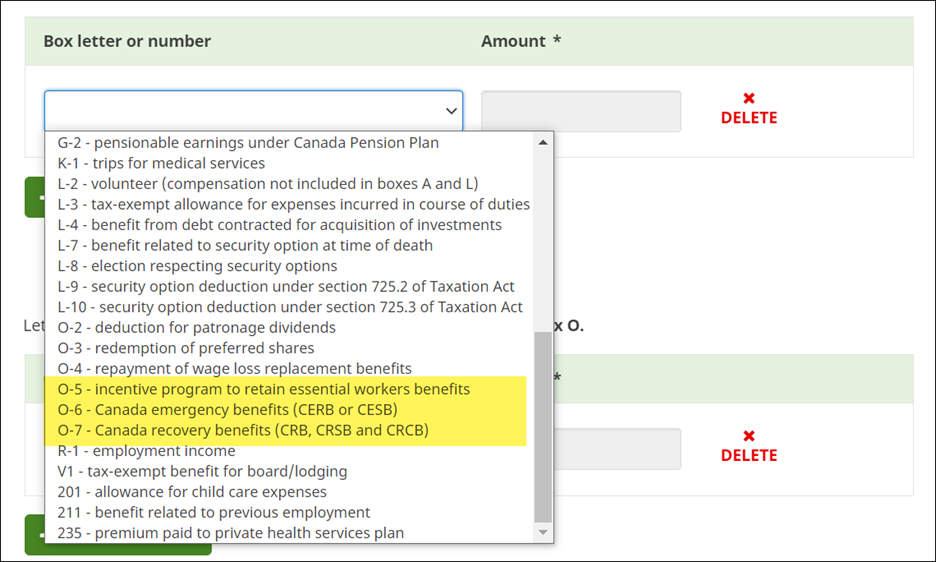

If you have an amount in Box O on your RL-1 slip for income that is related to the Incentive to Retain Essential Workers Program (IPREW), Canada emergency benefits (CERB or CESB), or Canada recovery benefits (CRB, CRSB and CRCB), select the applicable number from the Box number or letter drop-down list:

-

O-5 for IPREW

-

O-6 for CERB or CESB

-

O-7 for CRB, CRSB, and CRCB

If you have an amount in Box O for income that is related to a scholarship, fellowship, or bursary, select code RB in the area for details about Box O .

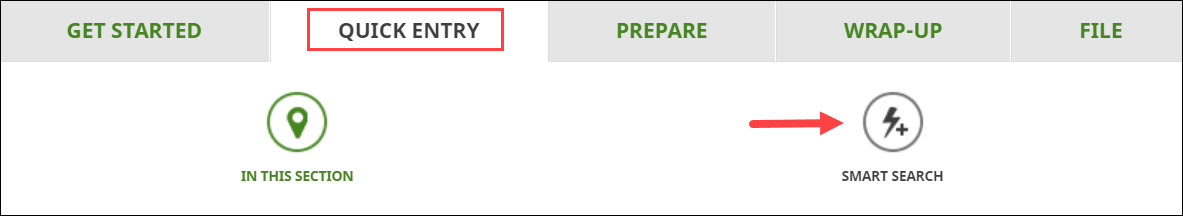

Follow these steps in H&R Block’s 2020 tax software:

- Type RL-1 or relevé 1 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the RL-1 page, enter your information into the tax software.

Note: On the RL-1 page, be sure to indicate if your RL-1 slip is an original or an amended* slip by selecting your response to the following question: Is this RL-1 slip an original or amended slip?

*An amended slip is a slip that was changed by the employer or preparer to correct an error or to add new information.