Relevé 19: Advance payment of tax credits (RL-19)

The Relevé 19 (RL-19) slip reports the advance payments of tax credits you received during the year for the following programs:

- The work premium, the adapted work premium, or the supplement to the work premium

- Childcare expenses

- Home-support services for seniors

- Treatment of infertility

When you request the advance payment of a credit related to one of the categories listed above, Revenu Québec will estimate your credit amount. This amount is then paid out to you in equal monthly instalments throughout the year. Remember, the advance payments of all tax credits reported on your RL-19 slip are considered income.

If the credit amount that Revenu Québec estimated ends up being too high, you will need to repay the extra amount back to Revenu Québec.

Important: If you don’t report the amounts shown on your RL-19 slip, Revenu Québec will withhold the amount you owe from any refund you might be entitled to.

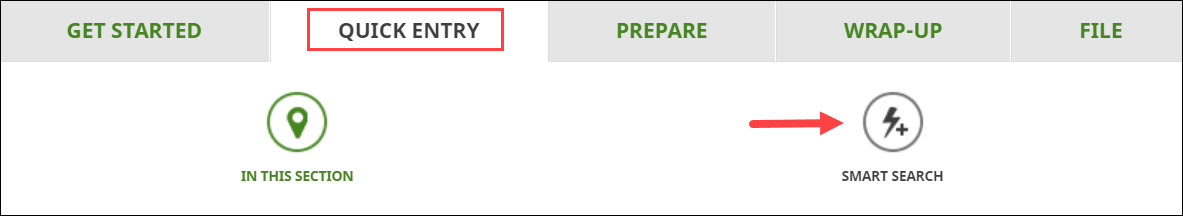

Follow these steps in H&R Block’s 2020 tax software:

- Type RL-19 or relevé 19 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your RL-19, enter your information into the tax software.