T5007: Statement of benefits

The T5007 slip reports the amount of workers’ compensation benefits and social assistance payments you received during the year from a provincial, territorial, municipal agency or a board.

While generally non-taxable, the income reported on your T5007 slip is used to determine your eligibility to receive certain federal and provincial credits (like the GST/HST credit and the Canada child Benefit).

Note: If you’re filing a Québec return, you’ll also need to add the information from your corresponding Relevé 5 slip into the tax software.

Tax Tip: If you lived with a spouse or common-law partner and you received social assistance payments during the year, the spouse with the higher income must be the one to report the assistance payments, even if their name isn’t on the slip. If your net income is identical, the person whose name appears on the slip must report these benefits.

Follow these steps in H&R Block’s 2020 tax software:

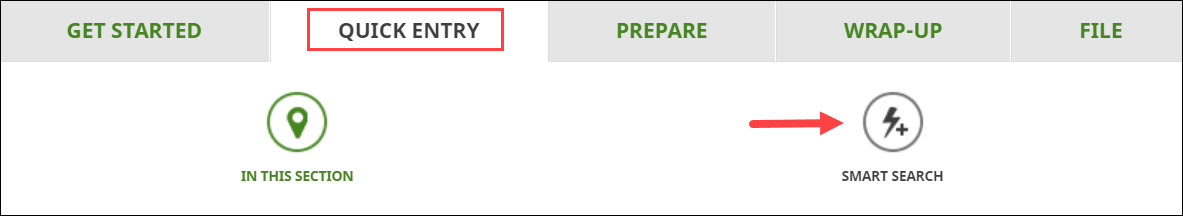

- Under the QUICK ENTRY tab, click the SMART SEARCH icon. You'll find yourself here:

- Type T5007 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your T5007 slip, enter your information into the tax software.

Notes:

- Box 13 of your T5007 slip is used to indicate if the slip is an original, amended, or cancelled slip and is for information purposes only. Since it isn’t required for return filing purposes, it doesn’t need to be entered on the T5007 page of the software.

- If you are a Manitoba resident or you moved from Manitoba to another province during the year, you’ll have a box 14 on your T5007. Enter the percentage shown in box 14 of your slip into the designated field of the T5007 page. If you aren’t a resident of Manitoba or don’t have an amount in box 14 of your T5007 slip, leave it blank.