Where do I enter my union and professional dues?

Depending on your situation, you’ll report the amounts you paid for union and professional dues differently. Choose the situation that applies to you, and follow the instructions:

- My union and professional dues were deducted by my employer (reported on a T4 or an RL-1 slip)

- I paid professional or union dues, but they weren’t reported on a slip

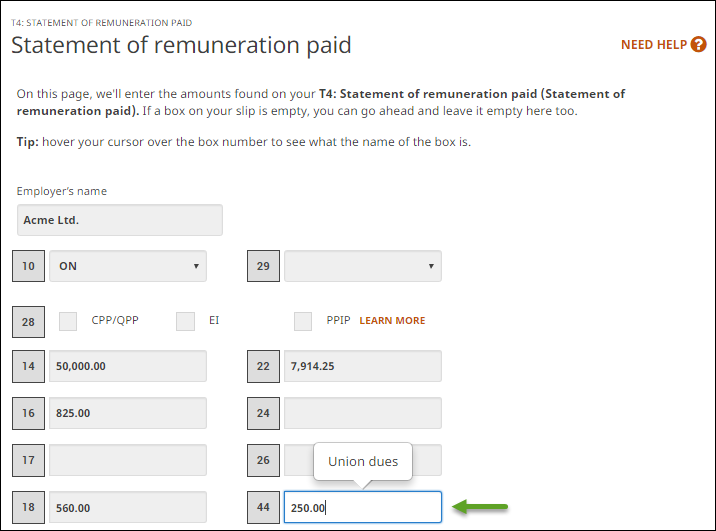

If you paid annual union, professional, or similar dues through a payroll deduction, the amount you paid can be found in box 44 of your T4 slip.

Follow these steps to enter this amount into the designated field of H&R Block’s tax software:

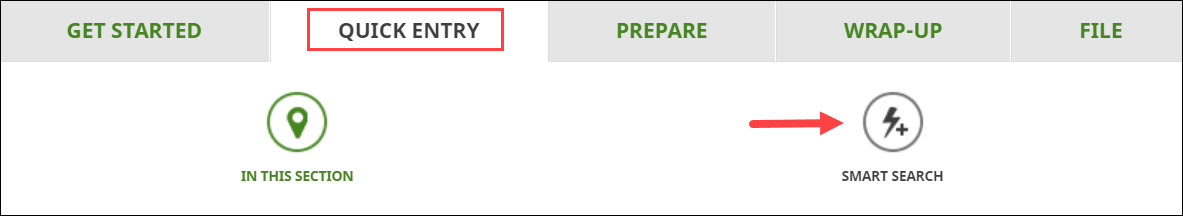

- Type T4 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your T4, enter the amount reported in box 44 of your paper T4 slip into the designated field of H&R Block’s tax software:

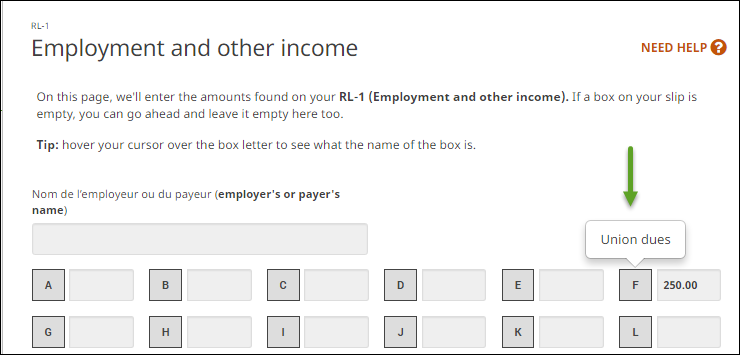

If you’re a resident of Québec and you were issued an RL-1 slip with your T4, you’ll also need to enter the amount found in box F of your paper RL-1 slip into the RL-1 page of the tax software. To do this:

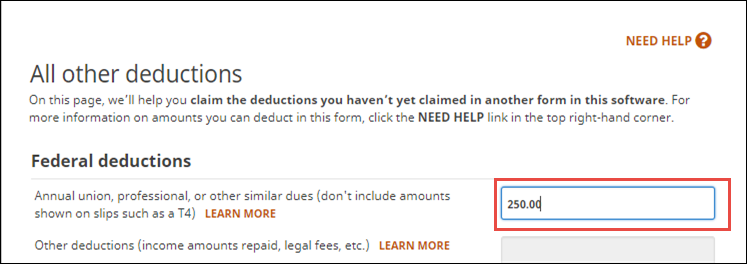

If you paid professional or union dues and your T4 or RL-1 slip doesn’t show the amount you paid, but you received a receipt from the organization to which you paid the dues, you can enter the amount on the All other deductions page:

- Under the PREPARE tab, click the OTHER icon.

- Under the MISCELLANEOUS heading, select the checkbox labelled All other deductions, then click Continue.

- When you arrive at the All other deductions page, enter the amount you paid for professional or union dues as shown on your receipt (include any GST/HST that was paid on this amount):

Note: If you’re a resident of Québec, H&R Block’s tax software will automatically calculate your union or professional dues deduction for your Québec return, based on the amount you enter in this field.