Climate action incentive (CAI) rebate

The Climate action incentive (CAI) is a refundable credit which consists of a basic amount and a supplement for residents of small and rural communities. If you’re a resident of Ontario, Manitoba, Alberta, and Saskatchewan you can apply for the CAI rebate on your 2020 tax return. Your CAI rebate amount will depend on:

- the province you live in

- your marital status and

- the number of children in your family

Note: If you’re a resident of Yukon, you can claim the Yukon Government Carbon Price Rebate.

If you live in an area that is outside a census metropolitan area (CMA), you will qualify for the CAI supplement for residents of small and rural communities – an additional 10% of the payment amount you’re entitled to. For more information, refer to CAI supplement for residents of small and rural communities.

Basic CAI rebate amount

You’re eligible for the basic CAI rebate if, on December 31, 2020, you were a resident of Alberta, Manitoba, Ontario, or Saskatchewan and you meet any of the following conditions:

- You were 18 years of age or older

- You had an eligible spouse or a common-law partner or

- You were a parent who lived with your child (a qualified dependant)

You can’t claim the CAI rebate if at any time in 2020:

- You were a non-resident of Canada (this means if you moved to Canada in 2020, you won't be able to claim the CAI rebate)

- You were confined to a prison or a similar institution for 90 days or more during the year

- You were an officer or servant of a foreign government (such as a diplomat) or you were a family member who lived with such a person or an employee of such a person

- You were a person for whom Children’s special allowance (CSA) payments were payable (these are non-taxable monthly payments paid to an individual as financial assistance by an agency under the Children’s Special Allowances Act to maintain a child under 18 years of age living in Canada).

Note: You can’t claim the CAI amount for your spouse and/or child, if they were a person for whom CSA payments were payable.

CAI supplement for residents of small and rural communities

To claim the CAI supplement for residents of small and rural communities, you must meet the eligibility requirements for the basic amount and must have lived outside of a census metropolitan area (CMA) on December 31, 2020, as defined by Statistics Canada in the last census they published before 2020.

You can’t claim the supplement amount if you lived in the following CMAs:

- Alberta: Calgary, Edmonton, and Lethbridge

- Ontario: Barrie, Belleville, Brantford, Greater Sudbury, Guelph, Hamilton, Kingston, Kitchener-Cambridge-Waterloo, London, Oshawa, the Ontario part of Ottawa-Gatineau, Peterborough, St. Catharines-Niagara, Thunder Bay, Toronto, and Windsor

- Manitoba: Winnipeg

- Saskatchewan: Saskatoon and Regina

Note: Each CMA is made up of several municipalities. If you live in a municipality that falls under one of the above CMAs, you won’t be able to claim the supplement amount. For example, if you live in Mississauga (Ontario), you won’t be able to claim the supplement because Mississauga is a part of the Toronto CMA. Click here to see if your municipality falls under one of the CMAs listed above.

If you lived outside of a CMA, respond Yes to the question Did you live outside a census metropolitan area on December 31, 2020, as defined by Statistics Canada?. You can find this question on the Your residence page under GET STARTED.

For the purpose of the CAI, an eligible spouse or common-law partner must meet all the following conditions:

- They were your spouse or common-law partner on December 31, 2020

- They were a resident of Canada throughout 2020

- They were not a person for whom CSA payments were payable

- They weren’t confined to a prison or a similar institution for a period of at least 90 days during the year

- They weren’t exempt from income tax in Canada at any time in 2020 because they were an officer or servant of the government of another country (such as a diplomat)

- They didn’t die before April 1, 2021

For the purpose of this tax credit, a qualified dependant is one who meets all the following conditions:

- They were your or your spouse's or common-law partner's child

- They were under 18 years of age on December 31, 2020

- They lived with you on December 31, 2020

- They were a resident of Canada throughout 2020

- They weren’t married or living common-law on December 31, 2020

- They weren’t a parent who lived with their child on December 31, 2020

- They were not a person for whom CSA payments were payable

- They weren’t confined to a prison or a similar institution for a period of at least 90 days during the year

- They weren’t exempt from income tax in Canada at any time in 2020 because they were an officer or servant of the government of another country (such as a diplomat)

- They didn’t die before April 1, 2021

The Children’s special allowance (CSA) is a monthly non-taxable payment that is paid to an individual by an agency (such as a group foster home or institution, or a federal, provincial or territorial government department or agency appointed for the protection and care of children) under the Children’s Special Allowances Act to maintain a child under 18 years of age living in Canada.

You receive CSA payments, if as a permanent or temporary guardian, tutor (in Québec), or as someone who has been given all rights and duties of a parent under a court order or judgement, you receive financial assistance from an agency. For example, if you’re a foster parent and are receiving financial assistance from an agency – you’re receiving CSA.

Note: The Climate action incentive (CAI) rebate can’t be claimed if the following applied:

- You or your spouse is the person for whom CSA was payable.

- Your child is the person for whom CSA has been paid.

H&R Block’s 2020 tax software will automatically claim this rebate for you based on the information you enter in your return (such as your province of residency, marital status, number of children, and if you, your spouse, or your children received CSA payments).

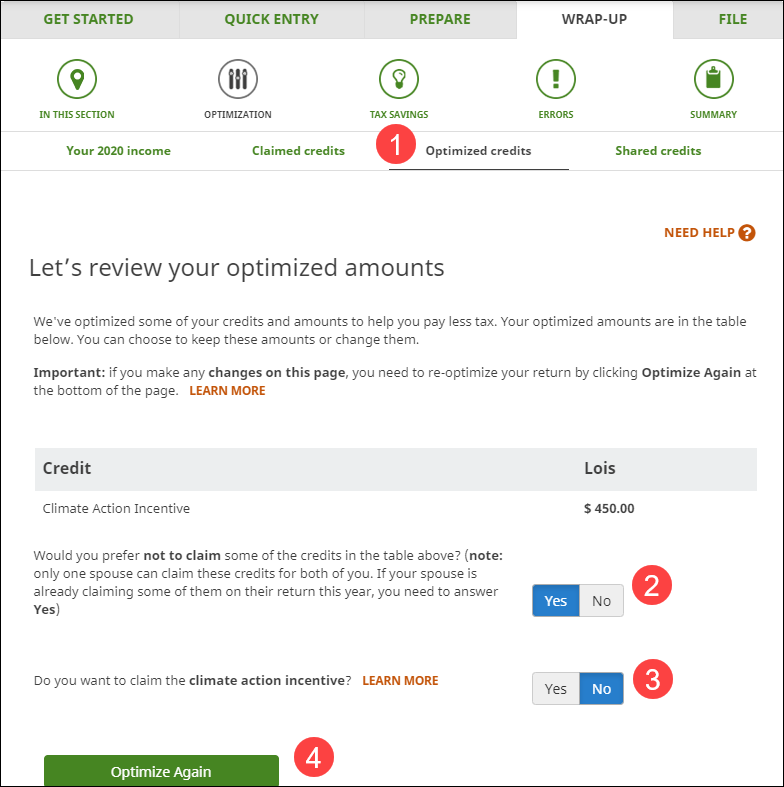

If you want to change who is claiming the rebate amount or don’t want to claim it at all, you can make the change in the OPTIMIZATION section under the WRAP-UP tab of your return.

- Under OPTIMIZATION, go to the Optimized Credits page.

-

Answer Yes to the question Would you prefer not to claim some of the credits in the table above?.

- Answer No to the question Do you want to claim the climate action incentive?.

- Click the Optimize Again button to see changes to your refund or tax owing amount.