Canada Emergency Response Benefit (CERB)

The Emergency Care Benefit and Emergency Support Benefit announced by the government in response to COVID-19 on March 18, 2020 has been repackaged into a simpler Canada Emergency Response Benefit (CERB).

The CERB will provide temporary income support to employed and self-employed Canadians who have lost their income due to COVID-19. This includes employed, self-employed, wage earners, and contract workers who aren’t getting paid because they:

- lost their job

- are self-isolating or are quarantined

- are sick with COVID-19 or are taking care of a loved one with COVID-19 or

- must stay home to care for children who are at home because of school and day care closures

The CERB will provide a payment of $2,000 per month for 4 months ($500 per week for up to 16 weeks). The benefit is available from March 15, 2020 to October 3, 2020.

Note: The CERB is taxable income. You will need to report it on your next year’s (2020) tax return.

You were eligible for the CERB payment if you:

- Live in Canada and are at least 15 years old

- Stopped working due to COVID-19 OR are eligible for Employment Insurance (EI) benefits (regular or sickness) OR have exhausted your EI regular or fishing benefits between December 29, 2019 and October 3, 2020

- Had at least $5,000 in income (from employment, self-employment, non-eligible dividends, and/or maternity or parental benefits) in 2019 or in the 12 months prior to the date of your application and

- Did not earn more than $1,000 in employment and/or self-employment income for at least 14 consecutive days, within the 4-week benefit period of your claim.

If you didn't stop working or if you voluntarily quit your job, you were not eligible for this benefit.

In order to verify that you didn’t earn more than $1,000 in employment income during the specified period of your claim, your employer will report any income or retroactive payments you received on your T4 slip.

In addition to reporting your employment income in Box 14 or Code 71, your employer will use the following codes to report any amounts you were paid between the following dates in 2020:

-

Code 57: March 15 to May 9

-

Code 58: May 10 to July 4

-

Code 59: July 5 to August 29

-

Code 60: August 30 to September 26

If you have any of these amounts on your T4 slip, you’ll need to report them on your 2020 tax return.

If your situation changed during the period of your CERB claim or if you made an honest mistake while applying, you might receive a letter from the government asking you to repay some of the CERB amounts you received.

If you repaid your CERB amounts before December 31, 2020, you won’t owe tax on the benefits you received when you file your 2020 return. If you still need to repay your CERB amounts to the CRA or Service Canada by January 1, 2021, you’ll owe tax on the full amount of payments you received when you file your 2020 return.

If you repay your COVID-19 benefits in 2021, the amount you repaid (and the taxes you’ve paid on them) will be used to reduce the taxes you owe when you file your 2021 return. To find out if you might need to repay the CERB and how to do so, visit the CRA website.

In February 2021, the government announced that self-employed individuals who mistakenly applied for the CERB based on their gross income (the amount you made before subtracting your work-related expenses) are no longer required to pay back their benefits.

This means you might not have to repay your CERB amounts if:

-

You’re self-employed

-

You earned at least $5,000 in 2019 before subtracting your expenses and

-

You meet the other eligibility requirements

If you already repaid your CERB amounts but you’re now considered eligible for the benefit, the CRA and Service Canada will give you back the amount you repaid. More details about these repayments are coming soon.

The CRA and Revenu Québec won’t charge interest on the taxes you owe from your 2020 return until April 30, 2022 if:

-

You received a federal or provincial COVID-19 relief benefit, including CERB; and

-

Your taxable income is less than $75,000 in 2020

You’ll still need to file your return by April 30, 2021 for the CRA and May 31, 2021 for Revenu Québec to avoid late filing penalties.

If you received CERB payments from the CRA and received a T4A slip, follow these steps in H&R Block’s 2020 tax software:

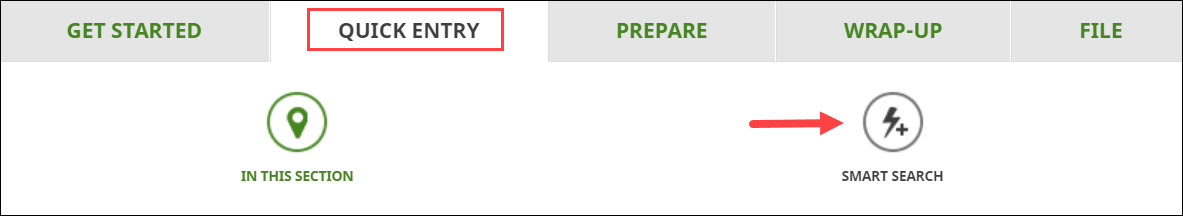

- Type T4A in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the T4A page, enter your information into the tax software.

Note: If you also received an RL-1 slip from your employer(s), follow the steps above to enter your information into the tax software.

If you received CERB payments from Service Canada and received a T4E slip, follow these steps in H&R Block’s 2020 tax software:

- Type T4E in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the T4E page, enter your information into the tax software.

Note: If you also received an RL-1 slip from your employer(s), follow the steps above to enter your information into the tax software.

- How COVID-19 relief measures might affect your taxes this year (H&R Block Online Help Centre)

- Canada Emergency Response Benefit (CERB) (Government of Canada website)

- Questions and Answers on the Canada Emergency Response Benefit (Government of Canada website)