T5008: Statement of securities transactions

You’ll receive a T5008: Statement of securities transactions slip from your broker for securities that you, or someone on your behalf bought, sold, or cashed during the year. Depending on your situation, this slip can include any of the following:

- Bonds, debentures, promissory notes, other similar properties

- Publicly traded shares, mutual fund units, debt obligations, options or contracts

- Deferral or eligible small business corporation shares and other shares

- The disposal of T-bills at maturity

It’s up to you to keep track of the securities you buy or sell, as well as the adjusted cost base (ACB)* of each investment, so that you can properly report capital gains or losses once you dispose of them.

* ACB refers to the amount you paid for the investment as well as any expenses you had to pay to buy them.

Note: If you’re a resident of Québec, you’ll also receive a Relevé 18: Securities transactions (RL-18) slip. Be sure to enter both the T5008 and the RL-18 slip into H&R Block’s tax software.

If you disposed of or sold securities during the year, you’ll have an amount in box 21 (Proceeds of disposition) of your T5008 slip. If that’s the case, you’ll need to make sure that you also report the amount in box 20 (Cost or book value) on your T5008 slip.

Generally, issuers of a T5008 slip leave box 20 empty as they might not know the total cost you paid to acquire the investment (which is your adjusted cost base (ACB)), or the amount might not reflect your true ACB. You’ll need to calculate your cost or book value and enter the correct amount in box 20 to properly report your capital gains or loss. The following expenses can be included when calculating your cost or book value:

- finders' fees

- commissions

- brokers' fees

- surveyors' fees

- legal fees

- transfer taxes and

- advertising costs

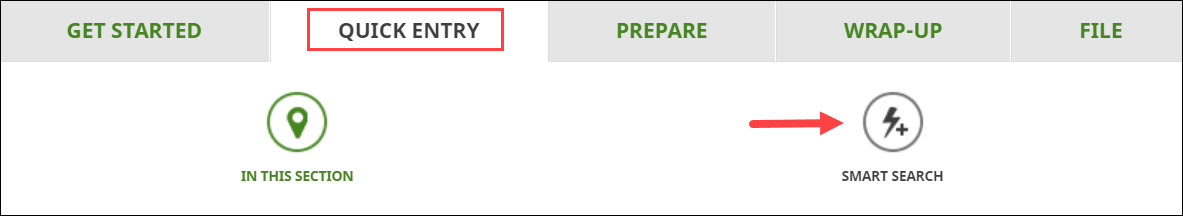

Follow these steps in H&R Block’s 2020 tax software:

- Type T5008 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the T5008 page, enter your information into the tax software.

Box 16

If the T5008 slip you received has an amount in box 16 that has more than two digits after the decimal (example, 13.0345), you can either round the amount to two decimal places or leave this box blank. This box is only used for information purposes and isn’t used in calculating your taxes.

Box 24

If you see a format related error on box 24 on the T5008 page, you can leave this box blank. Box 24 is only used for information purposes and isn’t used in calculating your taxes.